In the recent news, Citibank got merged with Axis Bank on 1st March, 2023. Under this Citibank merger with Axis Bank , Axis Bank acquired the Citibank India’s consumer business along with Citicorp Finance (a non-banking finance arm). Now, all the Citibank customers will be treated as Axis Bank customers post-merger.

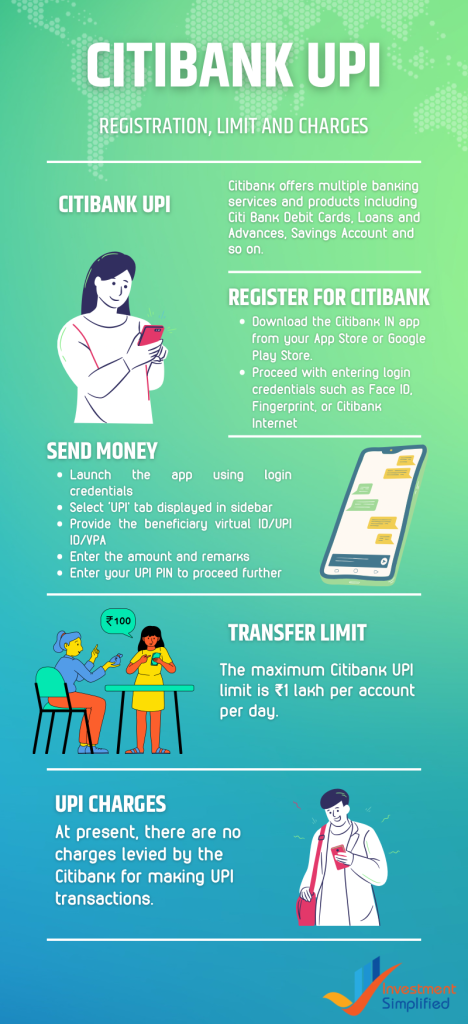

Citibank offers multiple banking services and products including Citi Bank Debit Cards, Loans and Advances, Savings Account and so on. Apart from these services, Citibank offers instant fund transfer option through its Citibank BHIM UPI Mobile App. In order to transfer from one account to other, Citibank UPI can be used via smartphones. Customers are required to make Citibank UPI registration to process the fund transfer.

What is Citibank UPI?

Citibank has introduced one of the finest ways to transfer funds from one bank account to other via UPI. Through Citibank UPI, customers do not require to enter bank details such as Citibank IFSC Code, bank accounts and other to make successful transfers. The transfer can be done through UPI ID or VPA within seconds.

Please Note-

- Use your IPIN to login to Citi Mobile App and transact

- Use your Citi Debit Card ATM PIN to authenticate all UPI transactions on BHIM or 3rd Party UPI Apps.

- All UPI compatible Apps can be downloaded from Google Play Store / App Store.

How to Register for Citibank UPI?

For Citibank UPI registration, the customer need to have an activated mobile banking facility. To proceed further, follow the below-mentioned steps-

Step 1: Download the Citibank IN app from your App Store or Google Play Store.

Step 2: Proceed with entering login credentials such as Face ID, Fingerprint, or Citibank Internet Banking password (IPIN).

Step 3: Now go to ‘UPI’ option

Step 4: Create your Virtual Payment Address (VPA) or UPI ID followed by setting up 6-digit UPI PIN to complete your registration process.

How to Send Money Using Citibank UPI?

After Citibank UPI registration, you can now send money to someone via UPI ID. To send money using Citibank UPI, follow the steps mentioned below-

Step 1: Launch the app using login credentials

Step 2: Select ‘UPI’ tab displayed in sidebar

Step 3: Provide the beneficiary virtual ID/UPI ID/VPA

Step 4: Enter the amount and remarks

Step 5: Enter your UPI PIN to proceed further

Step 6: You will receive a confirmation message of successful transaction

How to Collect/Request Money using Citibank UPI?

Apart from sending money to someone, users can also request/collect money payments from someone. To initiate the process, follow the steps mentioned below-

Step 1: Launch the Citi Mobile App.

Step 2: Open ‘Request’ tab displayed on the home screen of the app.

Step 3: Enter the UPI ID or Virtual Payment Address (VPA) of the person from whom you want to receive money.

Step 4: Enter the amount and remarks.

Step 5: Submit the request using UPI PIN.

Citibank UPI Transfer Limit

The maximum Citibank UPI limit is Rs. 1 lakh per account per day. Also, customers are provided with UPI limit of Rs. 2 lakhs per transaction for specific merchants and Rs. 5 lakhs per transaction for UPI IPO and RDS transaction. Customer can also make Citibank credit card payment through UPI.

Citibank UPI Charges

At present, there are no UPI charges levied by the Citibank for making transactions. However, in case of any query related to UPI, bank account and others, you can get in touch with the Citibank customer care to get your queries resolved.

Citibank UPI Customer Support

As Citibank customers are now served by Axis Bank, customers can get in touch with customer care team if facing any query, complaint, issue related to UPI transactions. You can call on toll-free number mentioned below to get your UPI queries resolved:

1-860-419-5555

Visit the following links to know more about UPI:

Citibank UPI : FAQs

Yes. you can use your Citibank account on UPI. In order to transact, use the below-given ways-

· Access your Citi Mobile App and create @citi or @citigold Virtual ID

· Enroll your Citibank savings or current account for UPI on BHIM or any 3rd Party UPI App

No. UPI is only available for domestic transactions.

Yes. Citibank Mobile App offers Scan & Pay option to users for transferring funds and making payments.

An ODR refers to the Online Dispute Resolution which is a facility offered to the customers to raise disputes for UPI transactions and track its status for closure in future.

It refers to the unique identifier to make secure UPI payments. Citibank UPI ID can be your name, email id, mobile number, etc. followed by @citi or @citigold.