A demand draft is a secure and convenient way to transfer funds from one bank account to another. It is often used for larger transactions, such as buying a property or making an international payment. However, it’s important to understand the validity period of a demand draft to ensure that your payment is processed correctly and on time.

What is Demand Draft Validity Period?

The validity period of a demand draft refers to the length of time during which it can be presented for payment. The validity period varies depending on the policies and regulations of the issuing bank. Some banks may have a validity period of 90 days, while others may allow demand drafts to be valid for up to six months or longer. It’s important to note that if a demand draft is not presented for payment within its validity period, it may be considered stale and no longer valid. This means that the funds will not be transferred, and the payment will need to be reissued. In some cases, the bank may also charge a fee for reissuing a stale demand draft.

To ensure that your demand draft is processed correctly and on time, it’s important to provide accurate and complete information when filling out the demand draft form. This includes the correct amount, payee information, and any necessary references or account numbers. It’s also important to provide the demand draft to the payee as soon as possible to ensure that it is presented for payment within the validity period.

Validity of Demand Draft in India

In India, the validity of a demand draft typically ranges from 3 months to 6 months, depending on the policies and regulations of the issuing bank. However, some banks may allow demand drafts to be valid for up to one year or longer.

If a demand draft is not presented for payment within its validity period, it may be considered stale and no longer valid. This means that the funds will not be transferred, and the payment will need to be reissued. In some cases, the bank may also charge a fee for reissuing a stale demand draft.

To ensure that your demand draft is processed correctly and on time, it’s important to provide accurate and complete information when filling out the demand draft form. This includes the correct amount, payee information, and any necessary references or account numbers. It’s also important to provide the demand draft to the payee as soon as possible to ensure that it is presented for payment within the validity period.

Demand Draft Validity Extension Letter

A demand draft validity extension letter is a written request to the issuing bank to extend the validity period of a demand draft. A demand draft is a secure and convenient way to transfer funds from one bank account to another, but it has a limited validity period during which it can be presented for payment. If the demand draft is not presented for payment within its validity period, it may become stale and no longer valid.

If you have a demand draft that has expired or is about to expire, you may be able to request a validity extension from the issuing bank. To do so, you can write a demand draft validity extension letter to the bank.

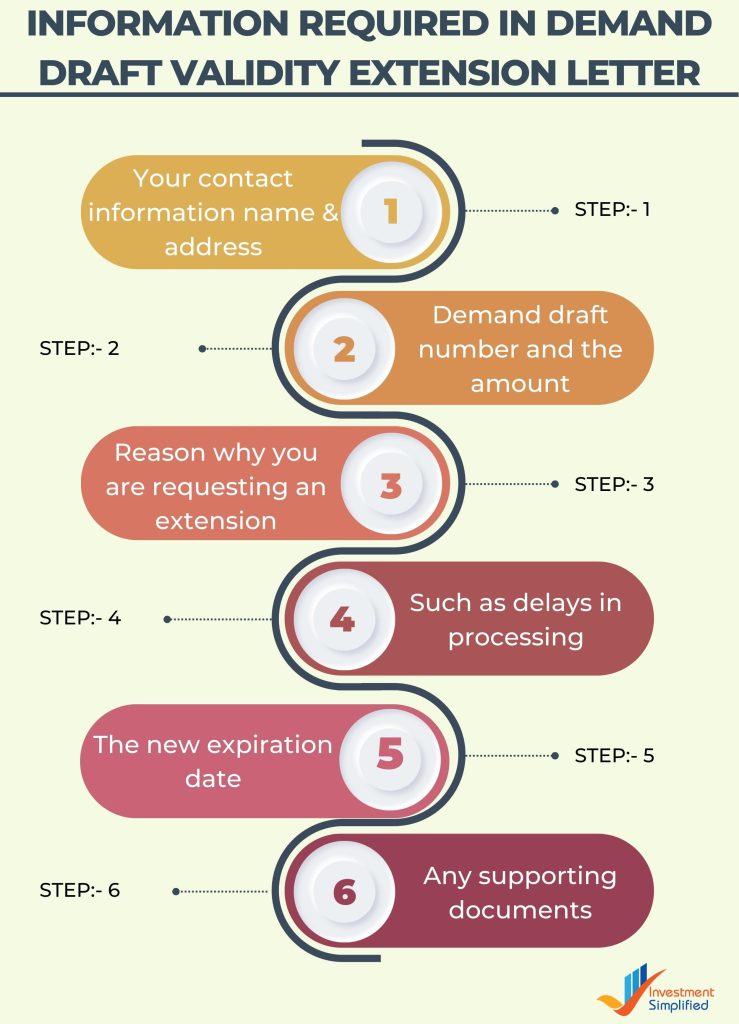

When writing the letter, be sure to include the following information:

- Your contact information, including your full name, address, and phone number.

- The demand draft number and the amount.

- The reason why you are requesting an extension, such as delays in processing or unexpected circumstances.

- The new expiration date that you are requesting for the demand draft.

- Any supporting documents, such as a letter from the payee acknowledging the delay or an explanation of the circumstances that caused the delay.

How Long Does it take for Demand Draft Clearance in India?

In India, the clearance time for a demand draft can vary depending on several factors, including the policies and procedures of the issuing and receiving banks, the amount of the demand draft, and the location where the transaction is taking place.

In general, the clearance time for a demand draft in India can range from 2 to 5 working days. However, this can vary depending on the location of the bank branches involved in the transaction. For example, if the demand draft is being processed between banks in different states, it may take longer due to the time required for inter-state transactions.

Additionally, the clearance time can also be affected by factors such as bank holidays, weekends, and the time required for verification and authentication of the demand draft. The issuing bank will need to ensure that the funds are available in the account before issuing the demand draft, and the receiving bank will need to verify the authenticity of the draft before releasing the funds.

Foreign Currency Demand Draft Validity

The validity of a foreign currency demand draft is typically determined by the policies of the issuing bank. In general, the validity period for a foreign currency demand draft can range from 90 days to 6 months, but it can be longer in some cases. It’s important to note that the validity of a foreign currency demand draft may differ from the validity of a domestic demand draft due to the currency exchange rates and the regulations of the countries involved in the transaction. The payee should verify the validity period with the issuing bank before accepting the demand draft to avoid any issues with stale or expired demand drafts.

If a foreign currency demand draft is about to expire or has already expired, the payee may request an extension of its validity period by writing a demand draft validity extension letter to the issuing bank. The letter should include the demand draft number, the amount, and the reason for the extension. It should also specify the new expiration date that the payee is requesting for the demand draft.

The bank will review the request and may approve or deny the extension based on its policies and regulations. If the extension is approved, the payee will be able to present the demand draft for payment within the new validity period specified by the bank.

Demand Draft Validity : FAQs

A demand draft is a type of financial instrument used to make payments, similar to a check. It is issued by a bank on behalf of the payer and is payable to a specific payee.

The validity period of a demand draft can vary depending on the policies and regulations of the issuing bank. In general, the validity period for a demand draft can range from 3 months to 1 year.

Yes, the validity period of a demand draft can be extended by submitting a request to the issuing bank. The request will be reviewed by the bank, and if approved, a new validity period will be specified.

If a demand draft expires, it cannot be honoured by the bank. The payee should request a new demand draft from the payer to avoid any delays or issues with the payment.

The clearance time for a demand draft can vary depending on several factors, including the policies and procedures of the issuing and receiving banks, the amount of the demand draft, and the location where the transaction is taking place. In general, the clearance time for a demand draft can range from a few days to several weeks.

Yes, a demand draft can be cancelled by submitting a request to the issuing bank. The bank will review the request and, if approved, will cancel the demand draft and refund the funds to the payer.

Yes, a demand draft can be reissued if it is lost or stolen, or if there is an error in the original draft. The payer should request a new demand draft from the issuing bank, and the bank will issue a new draft with the corrected information.