Did you know there is a limit on IMPS transactions that can be done in a day? If you’re an HDFC Bank customer, this article of IMPS Limit is for you. Read on to know all about the HDFC IMPS transfer limit.

HDFC IMPS Limit Per Day

Earlier in 2010, at the time of launching IMPS, the limit was set at Rs 1 lakh. However, the limit was enhanced later on.

Currently, the HDFC IMPS limit per day is set at Rs 5 lakhs per day. However, there are different ways to use IMPS and for each option, HDFC IMPS limit differs, viz.:

HDFC IMPS Limit: via Account Number

The following are the HDFC IMPS limits for when transferring funds via account number:

- Per transaction limit: Rs 5 lakhs

- Per day limit: As per TPT limits

TPT full form: Third Party Transfer

IMPS Limit HDFC: Via MMID

The HDFC IMPS (Immediate Payment Service) limit via MMID* is:

- Online: Rs 5,000 per day per Customer ID (netbanking OR mobile banking)

*MMID Full Form: Mobile Money Identifier (A 7-digit unique code assigned to a bank account)

HDFC Limit IMPS: via USSD

The maximum limit for HDFC IMPS transactions via USSD is Rs. 1,000 per day per Customer ID.

USSD Full Form: Unstructured Supplementary Service Data (*99#)

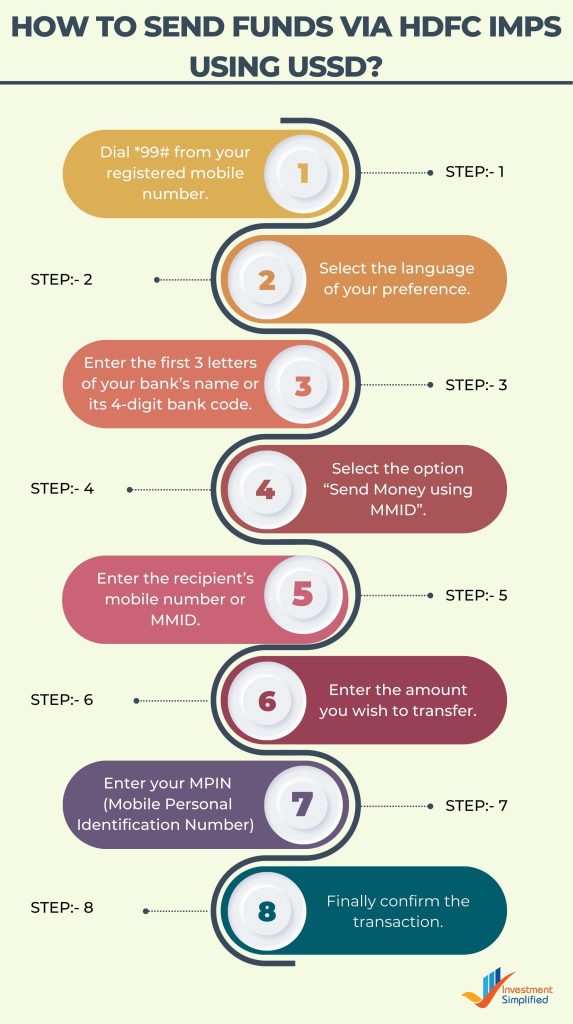

How to send funds via HDFC IMPS using USSD?

To send funds via HDFC IMPS using USSD, you can follow these steps:

Step 1: Dial *99# from your registered mobile number.

Step 2: Select the language of your preference.

Step 3: Enter the first 3 letters of your bank’s name or its 4-digit bank code. For HDFC Bank, you can enter either “HDF” or “5022.

Step 4: Select the option “Send Money using MMID”.

Step 5: Enter the recipient’s mobile number or MMID (Mobile Money Identifier) and confirm the same.

Step 6: Enter the amount you wish to transfer.

Step 7: Enter your MPIN (Mobile Personal Identification Number) and confirm the transaction.

Once the transaction is successful, you will receive a confirmation message from HDFC Bank on your registered mobile number. It’s important to note that you should have an active mobile banking account and have registered for IMPS service to use this facility. Additionally, you should have sufficient balance in your account to complete the transaction.

HDFC IMPS Charges

HDFC charges zero IMPS charges on digital transactions, i.e. via either the mobile banking or internet banking.

However, the bank does charge IMPS fees on transactions done at the bank. Go to our HDFC IMPS Charges post to know about the IMPS charges in HDFC Bank.

Also, check all related details about the IMPS:

HDFC IMPS Limit: FAQs

HDFC customers can transfer up to Rs 5 lakhs in a day using the IMPS mode.

You can make up to Rs 5 lakhs per transaction as per the HDFC IMPS rules. That said, it is the same for per day as well. If you’ve exhausted the entire HDFC IMPS limit in one transaction of Rs 5 lakhs, you won’t be able to make any more transactions in that day using the IMPS facility.

HDFC IMPS timings for online mode: 24×7

There are zero HDFC IMPS charges for online mode of transfer. Click here for HDFC IMPS charges at the bank.

IMPS stands for Immediate Payment Service.