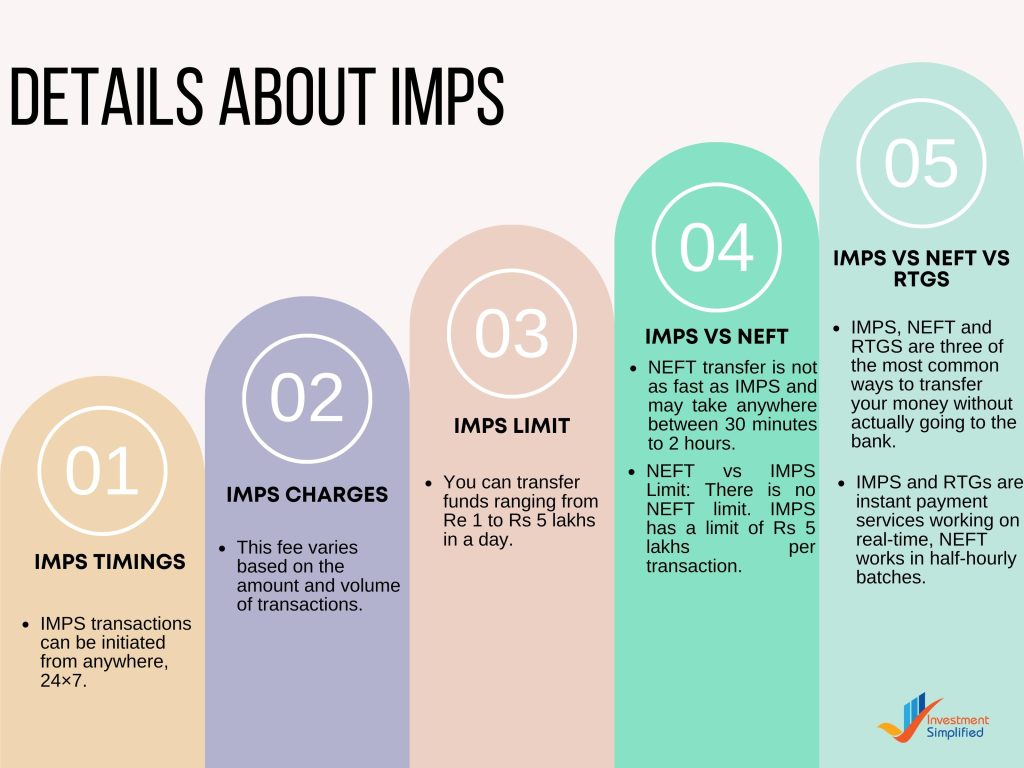

An instant inter-bank electronic way of transferring funds, IMPS is one of the many ways to transfer your funds without actually having to go to the bank. This means that IMPS transactions can be initiated from anywhere, 24×7. All you need is an active internet connection and a smartphone or computer to carry out the transaction.

Let’s know more about IMPS, IMPS timings, charges and more in the post below.

IMPS Charges

Banks levy IMPS charges to cover the costs associated with providing the IMPS service, which includes technology infrastructure, maintenance, and security measures. Apart from technology and security costs, banks also have to pay transaction processing fees to other banks that are part of the IMPS network. This fee varies based on the amount and volume of transactions.

Therefore, the fees charged by banks for IMPS transactions are to recover these costs and generate revenue. It’s worth noting that some banks offer free or discounted IMPS transactions as a promotional offer or for certain account types, so it’s always good to check with your bank for any such offers.

IMPS Limit

As per RBI, customers can transfer funds ranging from Re 1 to Rs 5 lakhs in a day. That said, banks are free to put IMPS limit for their customers but it should be within the parameters provided by RBI.

IMPS vs NEFT

Just like IMPS, there is another mode of funds transfer – NEFT which I short for National Electronic Funds Transfers. This is an electronic system in which 48 half-hourly batches are released in which NEFT requests are processed. NEFT transfer is not as fast as IMPS and may take anywhere between 30 minutes to 2 hours to credit the transferred amount to the beneficiary’s account.

For Detailed Comparison: IMPS vs NEFT

IMPS vs NEFT vs RTGS

IMPS, NEFT and RTGS are three of the most common ways to transfer your money without actually going to the bank. However, these services can be availed at the bank as well but when done at the bank, these attract certain charges. While IMPS and RTGs are instant payment services working on real-time, NEFT works in half-hourly batches.

For More: IMPS vs NEFT vs RTGS

When doing an IMPS transfer from your SBI account, it is imperative to know how much of the amount you can actually send. Thus, we provide you with all the information around SBI IMPS limit per day along with the IMPS limit SBI for every transaction. Read on.Previous

SBI IMPS LimitSBI IMPS ChargesSBI IMPS Limit: FAQsNext

SBI IMPS Limit

Earlier in 2010, when the IMPS system was launched, SBI was one of the only banks to be participating with RBI in the project. At that time, the IMPS limit was set at Rs 1 lakh per day. This was for all the participating banks (SBI, BOI, UBI, ICICI, HDFC, Axis and Yes Bank).

However, from 1st Feb 2022 i.e. 12 years from its inception, limit for SBI IMPS was enhanced. Currently, SBI IMPS limit is set at Rs 5 lakhs per day. Please note that this limit is not per transaction, i.e. you may make multiple transactions or a single transaction but it cannot go beyond Rs 5 lakhs in a day.

SBI IMPS Charges

There are no SBI IMPS charges when the transfer is done digitally, i.e. using either the mobile banking or internet banking option.

However, if done at the bank, you will be charged with:

Rs 5 for IMPS amount of up to Rs 1 lakh

Rs 15 for transfers above Rs 1 lakh and up to Rs 5 lakhs

Also, check all related details about the IMPS:

IMPS Timings: FAQs

IMPS is a real-time fund transfer system. This means that when talking of ‘IMPS time taken’, the request is processed as soon as it’s released. It takes no more than a few minutes to process the IMPS transfer request. So the next time you worry about how much time IMPS takes, just go ahead with your transaction as it is one of the quickest ways to transfer money.

Yes. IMPS is regulated by NPCI which is a non-profit organisation owned by RBI. Your transactions are tracked and if the transfer is incomplete, your money will still be safe. In all probabilities, you will get unprocessed IMPS amount back into your account.

If due to some reasons your IMPS request cannot be processed and the IMPS transaction fails, the amount will be refunded into your initial account.

Under normal circumstances, a failed IMPS transaction amount is refunded immediately. However, if there’s an issue, it may take up to 2 days for the bank to refund failed IMPS transaction amount into your account.

Yes, just like NEFT and RTGS, you can request an IMPS transfer at your bank branch as well. However, IMPS timings at the branch will not be 24×7 for the obvious reasons. Therefore, we suggest you check your bank timings before heading to perform an IMPS transaction at your bank. Also note that the IMPS charges at the branch may be higher than when done online via internet banking or mobile banking.