Read this article to compare & find the best IndusInd Bank Debit Card for you as per your usage and account profile. We have enlisted all the ways to generate PIN for you IndusInd Bank Debit Card along with activation process & more.

Best IndusInd Bank Debit Card in 2023

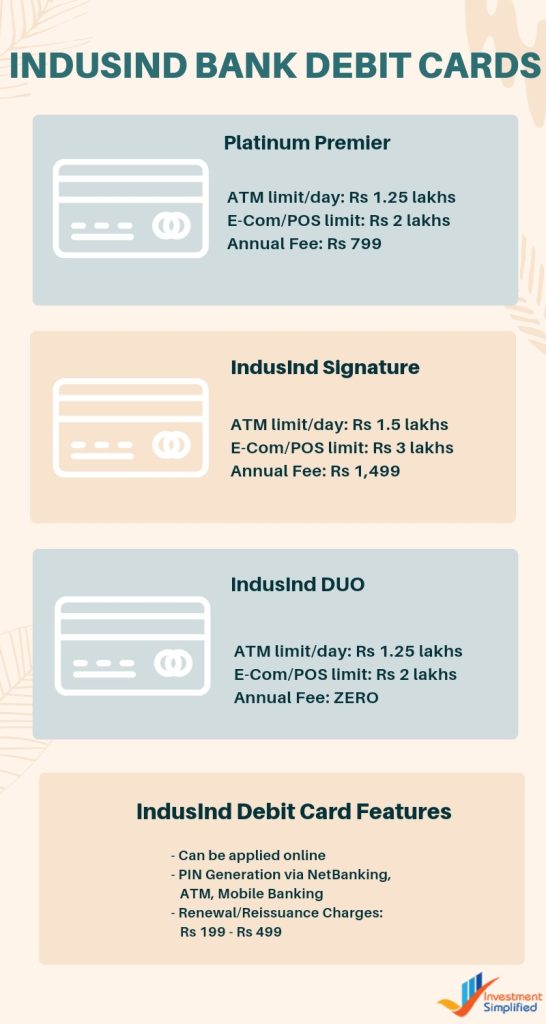

We have listed the top 3 IndusInd Bank Debit Cards in the table below along with their main features:

| IndusInd Bank Debit Card | Usage Limit | Salient Features |

| IndusInd Platinum Premier | ATM: Rs 1.25 lakhs Purchunases: Rs 2 lakhs | Annual fee: Rs 799 Rs 2 lakhs air accident cover Rs 2 lakhs personal accident cover Recurring payment set-up facility at major e-commerce merchants |

| IndusInd Signature | ATM: Rs 1.5 lakhs Purchases: Rs 3 lakhs | Annual Fee: Rs 1,499 Complementary airport lounge access Rs 5,600 worth of annual movie tickets |

| IndusInd DUO Card | ATM: Rs 1.25 lakhs Purchases: Rs 2 lakhs | Zero annual fee Rs 3,000 worth of annual movie tickets |

Please note that the annual charges incur GST as well. Check the updated GST Rates for 2023.

Types of IndusInd Bank Debit Cards

IndusInd Bank offers more than 25 debit cards under its umbrella to suit the varying needs of its customers. Here we are mentioning some of these debit cards by IndusInd Bank:

IndusInd Bank Pioneer Infinite Debit Card

Its a contactless debit card which offers movie tickets worth Rs 32,000/year with complementary airport lounge access and zero issuance fee and annual fee.

World Exclusive Debit Card

This card is good for those who shop in volumes. You get movie tickets worth Rs 6,000 every year with free airport lounge access. There is 0% cross currency mark-up when using this debit card.

Platinum Exclusive Debit Card

This debit card by IndusInd Bank offers higher ATM limit of Rs 2 lakhs and POS limit of Rs 4 lakhs daily. There is 1% cross currency mark up with no issuance fee or annual fee. In addition, you get worth Rs 6,000 of movie tickers, annually.

Platinum Select Debit Card

The following are the features of IndusInd Bank Platinum Select debit card:

- Annual movie tickets worth Rs 6,000

- 2% cross currency mark-up

- Higher transaction limits (Rs 1.5 lakhs for ATM and Rs 3 lakhs at POS

- NO issuance fee or Annual fee

Visa Signature Supreme Debit Card

The following are the features of IndusInd Bank Visa Signature Supreme debit card:

- Rs 5,600 worth of annual movie tickets

- Free airport lounge access

- Rs 10,000 worth of XtraSmiles Points

- Personal Accident Insurance: Rs 2 lakhs

- Air Accident Insurance: Rs 30 lakhs

Visa Signature Delite Debit Card

The following are the features of IndusInd Bank Visa Signature Delite debit card:

- Rs 5,600 worth of annual movie tickets

- Rs 7,500 worth of XtraSmiles Points

- Free airport lounge access

- Issuance Fee: Rs 7,500 (plus taxes)

- Annual Fee: Rs 1,499 (plus taxes)

Visa Signature Debit Card

Features of IndusInd Bank Visa Signature debit card are:

- Rs 5,600 worth of annual movie tickets

- Rs 5,000 worth of XtraSmiles Points

- Issuance Fee: Rs 5,000

- Annual Fee: Rs 1,499

Duo Premier Debit Card

Check the below-mentioned features of IndusInd Bank Duo Premier debit card:

- Rs 3,000 worth of annual movie tickets

- Rs 3,000 worth of XtraSmiles Points

- 2% cross currency mark-up

- Issuance Charges: Rs 3,000

- Annual Fee: Rs 799

Signature Exclusive VISA Debit Card

This card is good for those who shop in volumes. You get movie tickets worth Rs 6,000 every year with free airport lounge access. There is 0% cross currency mark-up when using this debit card.

World Select Debit Card

Features of World Select Debit Card are:

- ₹ 6,000 worth Annual Movie Tickets

- 1% Cross Currency Mark-up

- Complimentary Lounge Access

- Free Issuance/Annual Fee

Signature Select VISA Debit Card

Features of Signature Select VISA Debit Card are:

- ₹ 6,000 worth Annual Movie Tickets

- 1% Cross Currency Mark-up

- Complimentary Lounge Access

- Free Issuance/Annual Fee

Platinum Premiere Debit Card

Features of Platinum Premiere Debit Card are:

- ₹ 3,000 worth Annual Movie Tickets

- ₹ 2,500/- worth XtraSmiles Points

- 2% Cross Currency Mark-up

- ₹ 2500 + Taxes/ ₹ 799 + Taxes Issuance/Annual Fee

Duo Plus Card

Features of Duo Plus Card are:

- ₹ 3,000 worth Annual Movie Tickets

- ₹ 1,000/- worth welcome voucher

- 2% Cross Currency Mark-up

- ₹ 1,500 + Taxes/ ₹ 799 + Taxes Issuance/Annual Fee

Platinum Plus Debit Card with 1000 XtraSmile Points

Features of this card are:

- ₹ 3,000 worth Annual Movie Tickets

- ₹ 1000/- worth XtraSmiles Points

- 2% Cross Currency Mark-up

- Rs 1500 + Taxes/ Rs 799 + Taxes Issuance/Annual Fee

Platinum Plus Debit Card

Features of Platinum Plus Debit Card are:

- ₹ 3,000 worth Annual Movie Tickets

- 2% Cross Currency Mark-up

- Rs. 1000 + Taxes/ 799 + Taxes Issuance/ Annual fee

DUO Card

Features of Duo Card are:

- ₹ 3,000 worth Annual Movie Tickets

- 2% Cross Currency Mark-up

- ₹ 249 + Taxes Issuance Fee

- Free Annual Fee

Visa Platinum Debit Card

Features of VISA Platinum Debit Card are:

- 5X Reward Points

- 2% Cross Currency Mark-up

- Account Dependent Issuance/Annual Fee

- ₹ 1,00,000 / ₹ 2,00,000 ATM / POS (Point-of-Sale) Limits

Titanium Plus Debit Card

Features of Titanium Plus Debit card are:

- ₹ 1,000 worth Annual Movie Tickets

- ₹ 1,000 worth Annual Reward Points*

- Account Dependent Issuance/Annual Fee

- ₹ 50,000 / ₹ 1,00,000 ATM / POS (Point-of-Sale) Limits

Titanium Metro Plus Debit Card

Features of Titanium Metro Plus Debit Card are:

- ₹ 1,000 worth Annual Movie Tickets

- Metro Chip Embedded

- Account Dependent Issuance/Annual Fee

- ₹ 50,000 / ₹ 1,00,000 ATM / POS (Point-of-Sale) Limits

Titanium Debit Card

Features of Titanium Debit Card are:

- ₹ 1,000 worth Annual Reward Points*

- Account Dependent Issuance/Annual Fee

- ₹ 50,000 ATM Limits

- ₹ 1,00,000 POS (Point-of-Sale) Limits

Gold Debit Card

Features of Gold Debit Card are:

- ₹ 1,000 worth Annual Reward Points*

- Account Dependent Issuance/Annual Fee

- ₹ 50,000 ATM Limits

- ₹ 1,00,000 POS (Point-of-Sale) Limits

VISA Classic Debit Card

Features of VISA Classic Debit Card are:

- ₹ 800 worth Annual Reward Points*

- Account Dependent Issuance/Annual Fee

- ₹ 25,000 ATM Limits

- ₹ 50,000 POS (Point-of-Sale) Limits

RuPay Debit Card

Features of RuPay Debit Card are:

- ATM limit of Rs. 10,000

- POS limit of Rs. 10,000

Rupay Arthia Debit Card

Features of Rupay Arthia Card are:

- ATM limit of 25,000

- Point of sale (POS) limit 50,000

Visa Signature Debit Card

Features of Visa Signature Debit Card:

- ₹ 6,000 worth Annual Movie Tickets

- Complimentary Lounge Access

Delights Debit Card

Features of Delights Debit Card are:

- 5% Cashback on Fuel, Dining, Entertainment & OTT

- Buy One Get One Movie Ticket on Book My Show

- 20% off on Swiggy & 10% off on Big Basket

- ₹ 499 (+Taxes) Issuance/Annual Fee

How to Apply for IndusInd Bank Debit Card?

You can apply for an IndusInd Bank debit card online and offline, both. While for the offline process you need to go to the IndusInd Bank branch along with your PAN Card, resident proof and photograph, you can apply for a debit card of your choice (as per your eligibility) directly from the bank’s website. Here’s how:

- Go to IndusInd Bank website

- Click on Products and select Debit Cards under the Cards section

- You’ll be presented with a list of IndusInd Bank debit cards

- Choose a card of your choice and click on Apply Now on that card widget

- Enter your name, mobile number, state and city and hit the submit button to start the online application process

There are multiple ways via which you can generate your IndusInd Bank debit card PIN. The same are explained below.

How to Generate IndusInd Bank Debit Card PIN via Website?

Follow the steps given below for debit card PIN generation IndusInd Bank:

- Visit the IndusInd Bank official website

- Hover your cursor over the Quick Links option

- Click on Debit Card Related link

- Click on Set up your Debit Card PIN widget

- Fill up your IndusInd Bank debit card details

- Click on Submit to generate your PIN

How to Generate IndusInd Bank Debit Card PIN via Netbanking?

- Log into your netbanking account

- Click on Service Request

- Select Set PIN

- Enter your card details

- Create your new debit card PIN

How to Generate IndusInd Bank Debit Card PIN via ATM?

- Go to your nearby IndusInd Bank ATM

- Insert your debit card

- Choose the option to set new PIN

- Enter the details asked

- Enter the OTP that you’ll get on your regd. mobile number

- Create your IndusInd Bank debit card/ATM PIN

How to Generate IndusInd Bank Debit Card PIN via Mobile Banking (IndusMobile)?

- Login to the app

- Go to Service Request

- Select Set PIN option

- Enter your debit card details

- Create your new IndusInd Bank debit card PIN & confirm

- Click on Yes to set this PIN

Your PIN will be activated within 4 hours.

IndusInd Bank Debit Card Charges

The following are the card issuance/reissuance & renewal fees incurred on your IndusInd Bank Debit Card:

| Type of IndusInd Bank Debit Card | Fee |

| Classic (Domestic) | Rs 199 per annum |

| Classic (Chip) | Rs 249 per annum |

Check debit cards offered by different banks:

IndusInd Bank Debit Card: FAQs

Dial 18602677777 to block your IndusInd Bank debit card via phone banking. Alternatively, you can send an SMS (LOST DDMMYYYY to 9223512966) for blocking your debit card.

Eligibility of an IndusInd Bank debit card depends on your account profile. Depending on that, you are offered a debit card.

You can use your IndusInd Bank debit card for a single transaction of up to USD 2,500.

Yes. Firstly, you need to block your debit card via SMS, phone banking or netbanking/mobile banking and then apply for a replacement.

Yes. You can make bill payments using your debit card.