IndusInd Bank customers, if in need of transferring large amount of funds, can take the RTGS route which is available online and at-the-bank, both. Some of us prefer doing big payments at the bank only and thus, for this, IndusInd Bank RTGS form is needed to process the transfer request.

Read on to know how to download IndusInd Bank RTGS form and other details surrounding IndusInd Bank RTGS.

Download IndusInd Bank RTGS Form

To download the IndusInd Bank RTGS form in PDF format in your device, click the button given below. You will need this form to request RTGS from your account, or via cash.

Details Required for IndusInd Bank RTGS Form

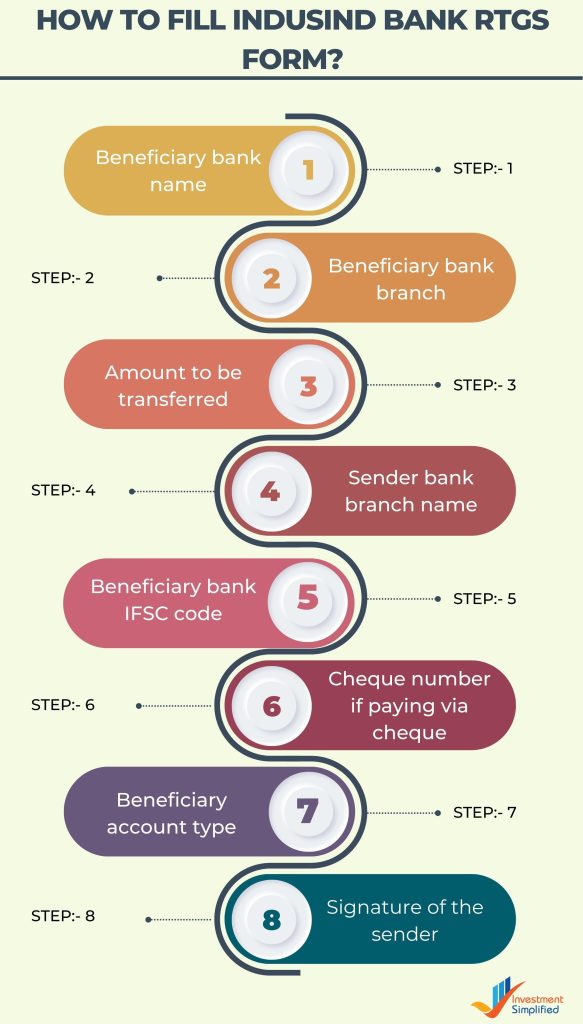

You need to fill the following mentioned details in IndusInd Bank RTGS form:

- Sender’s Details

- Name

- Debit account number

- Mobile n. and E-mail ID (non-customer)

- Beneficiary’s Details

- Name

- Account number

- Bank name and branch

- IFSC

- Amount (in figures and words)

- Details of cash remitted (if paying via cash) or cheque number

- Signature of the applicant

IndusInd Bank RTGS Timings

“Basis RBI guideline, Real Time Gross Settlement (RTGS) facility has been made available for you 24×7, w.e.f. 14 Dec 2020.”

Source: IndusInd Bank website

IndusInd Bank RTGS Charges

- For amount ranging from Rs 2 lakhs to Rs 5 lakhs: Rs 25 per transaction

- For amount greater than Rs 5 lakhs: Rs 50 per transaction

These charges are only applicable when you’re doing the transaction at the bank, i.e. by physically going to the bank and submitting the IndusInd Bank RTGS form. Online RTGS does not attract any charges for the IndusInd Bank account. Also, there are no charges for inwards RTGS transactions.

For more information about the bank’s services, you may go for the IndusInd Bank customer care for quick support.

IndusInd Bank RTGS Limit

The RTGS (Real-Time Gross Settlement) limit for IndusInd Bank varies based on the type of account and customer. Here are the details:

For Individual Customers:

- Minimum RTGS limit is Rs. 2 lakhs

- Maximum RTGS limit is Rs. 10 lakhs per transaction

For Non-Individual Customers:

- Minimum RTGS limit is Rs. 2 lakhs

- Maximum RTGS limit is Rs 25 lakhs

Important: The maximum limit mentioned above for both the types of customers is applicable when using a digital channel. Minimum limit remains the same, i.e. Rs 2 lakhs.

It’s important to note that RTGS transactions at the branch, can only be initiated during the RTGS working hours of the bank, which are typically from 8:00 am to 4:30 pm on weekdays and 8:00 am to 1:30 pm on Saturdays, except on the 2nd and 4th Saturdays of the month, when the bank is closed.

Visit the following links to know more about RTGS Form of different Bank’s:

IndusInd Bank RTGS Form: FAQs

When doing RTGS online via the IndusInd net banking option, you do NOT need IndusInd Bank RTGS form.

Minimum transaction for IDBI RTGS is Rs 2 lakhs, whereas there’s no maximum limit for it.

No. IndusInd Bank has one form for NEFT and RTGS, both. However, you can use the RTGS option only when the transfer amount is Rs 2 lakhs or more.

RTGS stands for Real Time Gross Settlement.