IndusInd is a growing private sector bank in India which offers multiple banking services like savings account and fixed deposits as basics and high-end products & services such as IndusInd netbanking, NEFT, insurance and mutual funds etc. In this post, we’ll talk about IndusInd Bank netbanking service; how to login to IndusInd netbanking and registration etc.

How to Register for IndusInd Bank NetBanking?

For the process of IndusInd net banking registration, you need to first have a bank account with the bank like an IndusInd Bank savings account. Next, this account must be linked to your mobile number. Post this, follow the steps given below to register for IndusInd Bank net banking:

Step 1: Go to the IndusInd Bank official website.

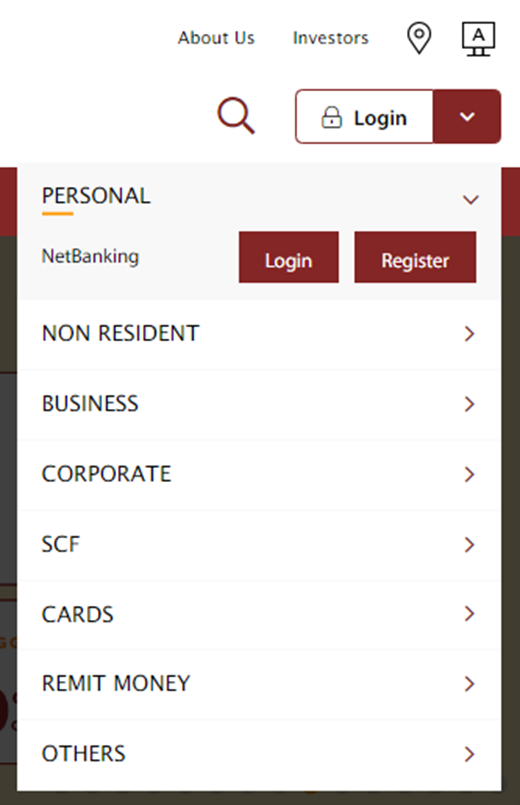

Step 2: Hover the cursor over the ‘Login’ button at the top-right corner and select the option of ‘Register’ (as shown in the snapshot below).

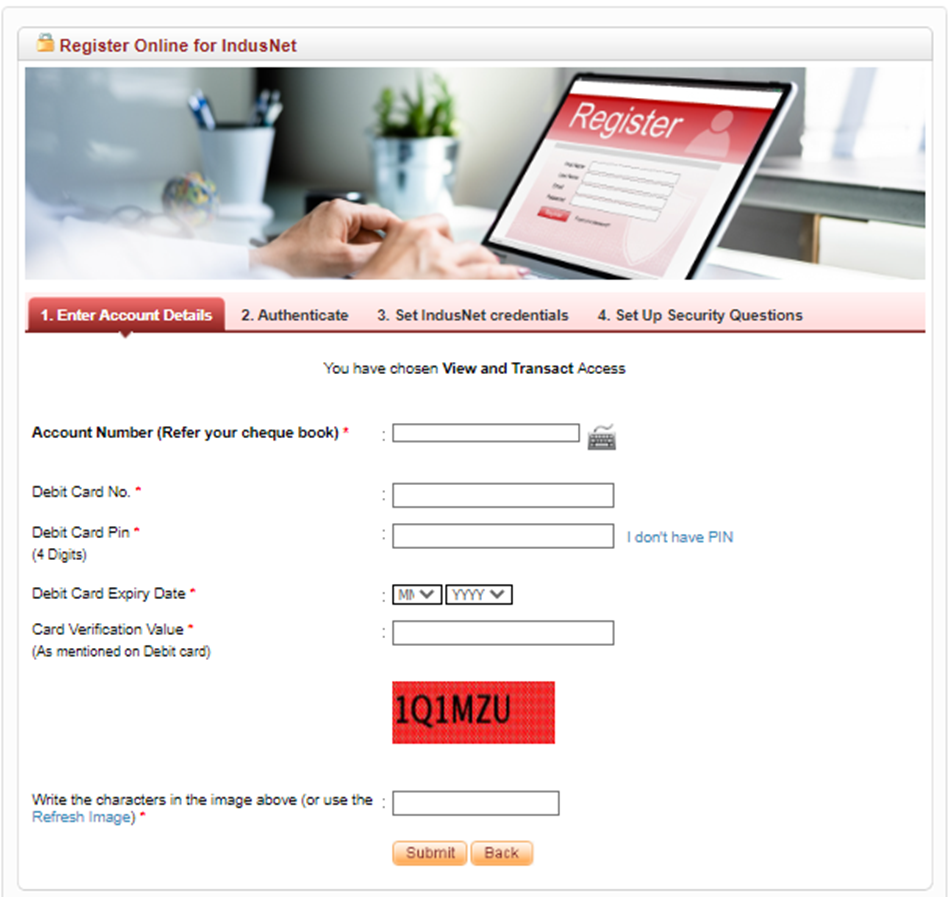

Step 3: Select the type of access you require: ‘View and Transact’ or ‘View Only’. (Refer the image given below).

Step 4: Fill your IndusInd Bank account details with your account number, IndusInd Bank debit card number & PIN, expiry date of the card and card verification value (mentioned on the card). (Refer the image below).

Step 5: Enter the security code (Captcha) as shown in the red box and finally click on ‘Submit’.

Next steps will involve you to authenticate with OTP, setting your IndusInd net banking login ID and password and lastly setting security questions. After these steps, your IndusInd Bank net banking account shall be processed and activated within the stipulated time.

How to Login to IndusInd Bank Net Banking?

To log into your IndusInd net banking account, these steps given further should be followed:

Step 1: Open the IndusInd Bank official website.

Step 2: Hover over ‘Login’ and select ‘Login’.

Step 3: Choose Enter your User ID and password. (Alternatively, you can login using IndusMobile as well. This is the newly launched IndusInd netbanking app).

Step 4: From the drop-down menu, select the purpose, i.e. for account summary, for funds transfers or service requests.

Step 5: Click on ‘Sign In’ to complete the process.

How to Reset My IndusInd Net Banking Password?

To reset your net banking password for the IndusInd Bank internet services or IndusNet, follow these steps:

Step 1: Go to the IndusInd Bank netbanking login page.

Step 2: Click on ‘Reset Login Password’ from the section to the side of the login panel.

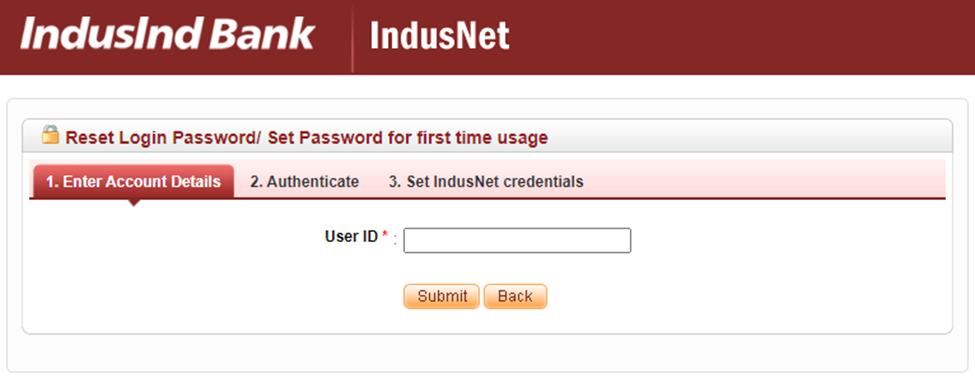

Step 3: Enter your User ID (refer the image given below).

Step 4: Next, authenticate your identity by entering OTP or answering the security questions, whichever option is available.

Step 5: At this step, create your IndusNet password. Make sure that it’s a strong one with a mix of alpha-numeric and special characters. Do not share it with anyone as this might make you lose access to your netbanking account and create a serious privacy and financial issue.

The above-mentioned steps will go for the IndusInd Net Banking first time password setting as well.

How to Activate or Unlock my IndusInd NetBanking User ID?

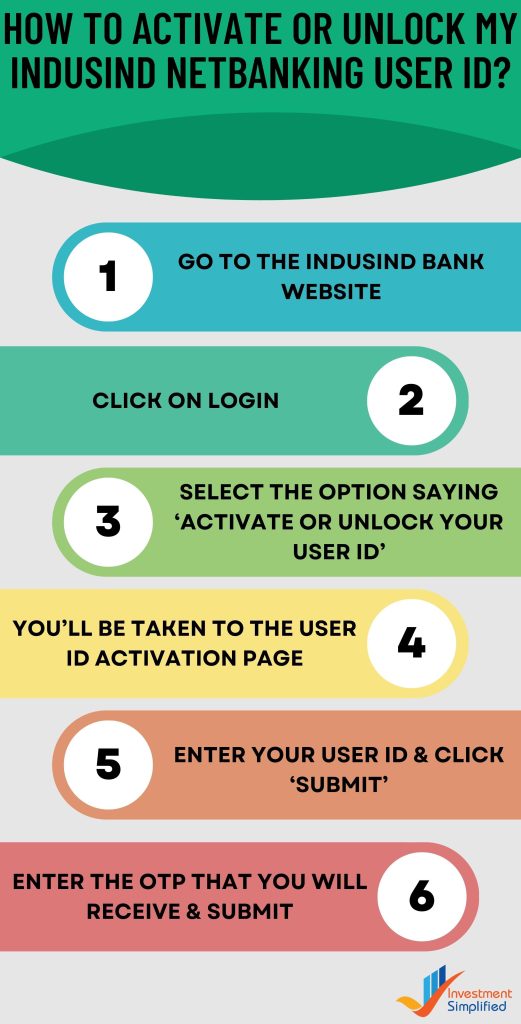

If you’re a first-time user of IndusNet or have forgotten your existing active User ID, the steps given below are to be followed for activate/unlocking of IndusNet User ID:

Step 1: Go to the IndusInd Bank website.

Step 2: Click on Login.

Step 3: Select the option saying ‘Activate or Unlock your User ID’.

You’ll be taken to the User ID activation page.

Step 4: Enter your User ID (this can be your customer ID, credit card) and click on ‘Submit’.

Step 5: Enter the OTP that you will receive on your registered mobile number and Submit.

That’s it.

How to Transfer Funds via IndusInd NetBanking?

To send money to someone else or transfer within your own IndusInd Bank accounts, you can use the IndusNet (Indus Netbanking) from anywhere at no charges. Steps for the same are:

Step 1: Login to your IndusInd Bank netbanking account.

Choose ‘Fund Transfer at the time of logging in.

Step 2: Open the Funds Transfer section from the dashboard.

Step 3: Click on ‘Manage Beneficiary’ (skip this step if you have already added one).

Step 4: Choose the transaction type from the drop-down menu (other bank’s account, IndusInd account, credit card bill payment or VISA credit card bill payment).

Step 5: Click on ‘Submit’.

Step 6: Add beneficiary details such as name, nick name, account number and IFSC.

Step 7: Enter the One-Time Password that you will receive on your registered mobile number and hit that ‘Submit’ button.

This message will flash on your screen: “Your IndusNetBeneficiary has been registered successfully. The Reference Id is XXXXXXXX”. Click on ‘Ok’.

Important: Please note that you can immediately transfer funds to a newly added beneficiary for an amount up to Rs 2 lakhs only. For a higher amount, you must wait for the next 24 hours.

Step 8: Click on Make Payment Now in the new beneficiary page or go to ‘Transfer Funds’ again.

Step 9: You’ll be redirected to ‘Transfer to other bank accounts (NEFT/RTGS/IMPS) by default. You may navigate to the other options from the side-bar as well.

Step 10: Enter details like your debit account, beneficiary account, transfer mode (it can either be NEFT or IMPS; for amount of Rs 2 lakhs or above, choose RTGS), amount and frequency, transaction remarks etc.

Step 11: Click on ‘Submit’.

Step 12: Enter the OTP that the bank will send you on your registered mobile number to verify. Click on ‘Submit’ once again.

After successfully submitting the OTP, your will get a confirmation message on your device screen, your mobile number and e-mail ID.

Features of IndusInd Net Banking

It is significant to remember that IndusNet is regarded as a user-friendly platform that provides convenient access to net banking services. By handling financial services either at home or at the office, you may save a lot of time. One needs to be informed of the top services offered by this internet banking system. A few of IndusInd’s useful features are as follows:

Account Research

Customers may monitor and manage account-related information online thanks to the existence of IndusNet. One may see the summary of their account and keep track of each transaction they make using IndusNet. Additionally, this online banking facility makes it simple to retrieve account statements and analyse transaction history. Even information about debit cards, such as transaction restrictions, is available to customers.

Financial Exchanges

Customers may quickly use the online fund transfer option with IndusInd Net Banking. Money can be sent to one’s own IndusInd account, to many IndusInd accounts, or even to third-party accounts controlled by other institutions. It’s interesting to note that online fund transfers can be planned for processing via RTGS, NEFT, or IMPS at certain intervals. The power to add and remove beneficiaries is also granted to the consumer. Above all, you may even use fund transfers to repay credit card bills.

Settling a utility bill

Utility bill payments can be made using the IndusNet Bill Pay service. With the help of this service, users may securely pay a variety of utility bills. Additionally, you may handle utility bill disbursement for power, DTH connection, mobile phone, and telephone along with instant bill payments without any fuss. You can also register the regular billers and receive reminders when payments are approaching due dates. Customers may even view their payment history, examine their billing records, and set up an automated schedule for payments to be made on a regular basis.

Handling mutual funds

Mutual funds are regarded as the most well-known investment choice chosen by a significant portion of the people in India. With IndusNet’s accessibility, one may easily determine their mutual fund investment range and further maintain a close eye on the registered investments. However, with this, you must first open a demat account.

IndusInd Bank Netbanking: FAQs

All you need is to go to the IndusInd Bank website and select ‘Register’ option under the ‘Login’ button on the top-right corner. After this, you’ll require your registered mobile number and IndusInd Bank debit card details to register.

If you do not have IndusInd Bank debit card, please call on any of these IndusInd Bank customer care numbers: 022-68577777 / 022-44066666 / 022-42207777 / 1860 267 7777.

Your IndusInd Bank customer ID is your netbanking User ID. It is mentioned on your IndusInd Bank passbook, cheque book and welcome kit.

These are the questions that you select and provide answers to while the IndusInd Bank net banking registration process. These are asked from you when you want to reset your IndusInd netbanking login password or have forgotten your User ID for the same.

Yes. You can make fund transfer using IndusInd Bank net banking to any of the bank acocunts.