Real Time Gross Settlement or RTGS is used to make money transfers where big volume transactions are involved. The RTGS payment system is operated and managed by the Reserve Bank of India. Although, there are certain RTGS charges and RTGS limits set by the RBI which is collected by the respective banks. It is of utmost importance that individuals should know the RTGS transfer limit in order to proceed with the transaction.

Maximum and Minimum RTGS Limit

The Reserve Bank of India has set a minimum and maximum limit for RTGS transaction. It is applicable for all banks across the nation. In this regard, the minimum RTGS limit set by the RBI is Rs. 2 lakhs and the maximum RTGS limit comes with no limit. However, banks can set their own RTGS maximum limit.

The RTGS allows instant transfer of funds to the beneficiary’s account in real-time. However, if customers want to make money transfer less than Rs. 2 lakhs, you can opt for NEFT and IMPS payment mode.

RTGS Transfer Limit by Top Indian Banks

The RTGS maximum and minimum limit vary from bank to bank. It is suggested that individuals should check the offline and online RTGS limit before you wish to initiate a RTGS transaction.

HDFC Bank RTGS Transaction Limit

| Minimum | Rs. 2 lakh |

| RTGS online limit | As per your set Third-Party Funds Transfer limit (Maximum up to Rs. 50 lakh per day) |

| RTGS limit per day at branches | No upper limit of RTGS transaction |

State Bank of India RTGS Limit

| RTGS lower limit | Rs. 2 lakh |

| RTGS upper limit | Rs. 10 lakh |

RTGS money transfer limit for corporate internet banking:

|

RTGS Minimum Limit |

Rs. 2 lakh |

|

|

Maximum RTGS Limit per transaction |

Saral |

Rs. 10 lakh |

|

Vyapaar |

Rs. 50 lakh |

|

|

Vistaar |

Rs. 2,000 crore |

|

|

RTGS Maximum Limit per day |

Saral |

Rs. 10 lakh |

|

Vyapaar |

No RTGS limit |

|

|

Vistaar |

No RTGS limit |

|

Visit the following links to know more about RTGS:

RTGS Limit: FAQs

The RTGS stands for Real Time Gross Settlement.

The minimum RTGS limit for all banks is Rs. 2 lakhs. This amount can be transferred via RTGS.

The RTGS facility is regulated and operated through the Reserve Bank of India.

The amount is reflected in the beneficiary’s account within 30 minutes.

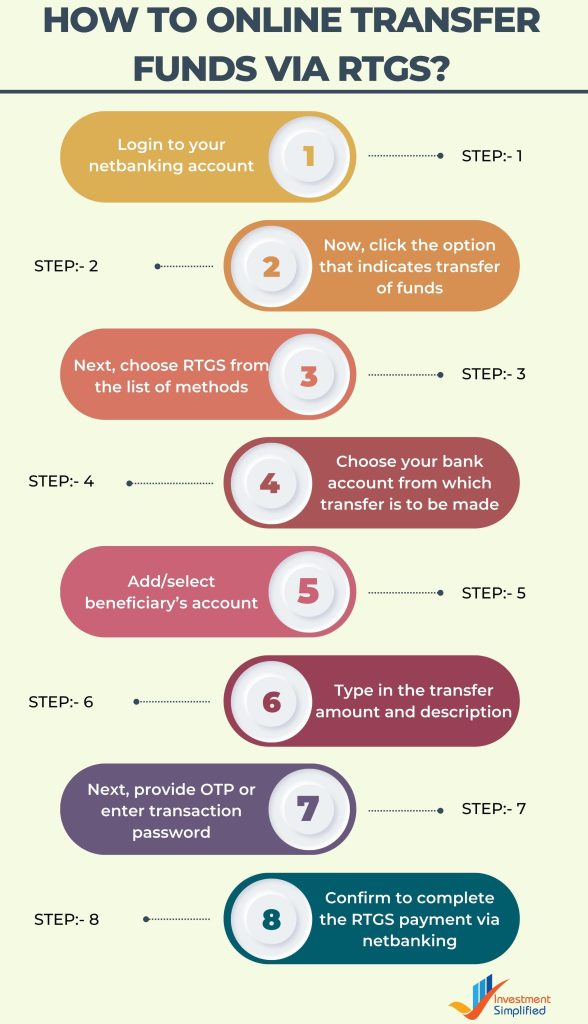

Yes. Using Net banking services you can make RTGS transaction and transfer funds to other’s account.