Among the many different fund transfers modes available for the SBI customers, SBI NEFT is one of the most popular digital modes. We’ll talk about how to do an SBI NEFT transaction in the same bank or other bank, SBI NEFT charges, NEFT timings and more. You may also scroll down to the FAQs section and get answers to some of the commonly asked questions about SBI NEFT.

SBI Fund Transfer – Multiple Fund Transfer Modes

SBI provides its customers with a multitude of fund transfer options, ranging from offline options like at the branch cheque deposit, draft, etc. to NEFT, IMPS, UPI and more. Here, we are listing all the online as well as offline fund transfer techniques one can use to transfer their funds via SBI:

Modes of Fund Transfer in SBI

SBI NEFT – How Does It Work?

This is a centralized fund transfer system which is owned and operated the apex body of the Reserve Bank of India, i.e. all the funds under the NEFT system are processed directly by the RBI. The same applies to SBI as well. Any payment done using the NEFT from any SBI account goes through the RBI channels and into to beneficiary’s account.

Payments are processed in half-hourly batches throughout the day.

Benefits of SBI NEFT

There are plethora of benefits of using SBI NEFT. Some of them are mentioned below:

- No upper limit or lower limit to process NEFT transactions

- Low fees and charges

- Safe and secure way to transfer funds

- Can be processed even through mobile banking and internet banking

Limitation of SBI NEFT Service

Some of the limitations of using using SBI NEFT service are given below:

- There is a fee for making SBI NEFT transfers while there is no fee in UPI payments

- Payments settlement might take more than 30 minutes while UPI, RTGS and IMPS are settled immediately

- Adding a beneficiary to your account might take 6 hours to 24 hours which is quite time consuming

Why should I transfer my funds using SBI NEFT?

The following are some of the advantages of using SBI NEFT which should answer this question of why should one use this mode of fund transfer:

- Available round the clock (when done via mobile or internet banking)

- Fund can be remitted Pan-India

- No charges to savings bank A/c customers when done online (netbanking or mobile banking)

- On delay in credit or return of transaction, penal interest is awarded to the affected customer by the bank

Source: Reserve Bank of India official website

DID YOU KNOW?

As per RBI, NEFT payments (one-way) can be done from India to Nepal as well.

How to Transfer Funds through NEFT from SBI to another Bank

You can transfer funds to any account outside SBI as well using the NEFT mode of payment. This is how to transfer funds using NEFT from SBI to another bank account:

Step 1: Login to your SBI netbanking account.

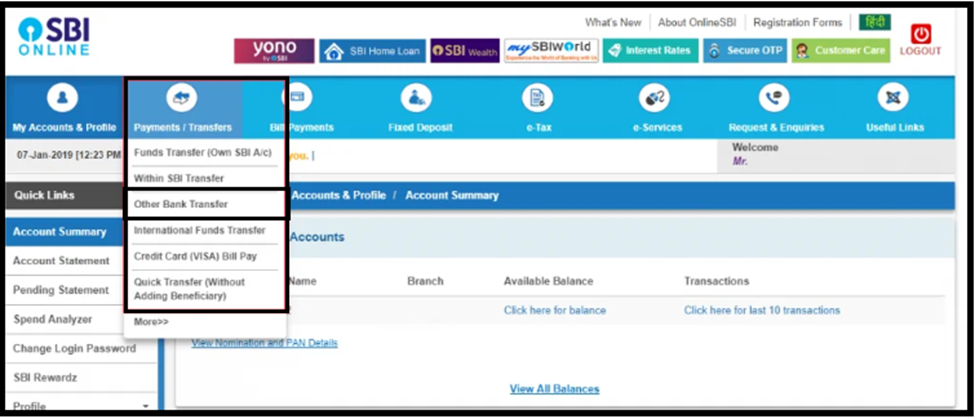

Step 2: Select “Other Bank Transfer” from the “Payments/Transfers” section on the menu at the top.

Step 3: Select NEFT as your transaction type and click on “Proceed”.

Step 4: Now, select the account from which you want to make the transfer, if you have multiple SBI accounts.

Step 5: Enter the amount, select purpose and choose from the list of beneficiary accounts. If you want to add a new beneficiary, click on “Click here to add a new Inter-Bank Beneficiary” just below you entered the amount.

Step 6: Select a schedule option from “Pay Now, Schedule Later or Standing Instruction” options.

Step 7: Read the Terms and Conditions and then confirm the same. Click on the “Submit” button.

Step 8: Go through the details and click on “Confirm” to completer the NEFT process.

You will receive a notification on your registered mobile number as well as your email ID upon successful transfer of the amount.

Read More: SBI Mini Statement

How to Transfer Funds through NEFT from SBI to another SBI Branch

Step 1: Login to SBI internet banking

Step 2: Click ‘Payments/Transfers’ and choose ‘Accounts of Others’ under the ‘Within SBI’ tab

Step 3: Select the account from which the transfer should be made

Step 4: Enter the amount you want to transfer

Step 5: Select the beneficiary account number and choose the ‘Select a schedule option’ to select at what time the fund needs to be sent. There are 3 options one can choose from: ‘Pay Now’, ‘Schedule Later’, or ‘Standing Instruction’

Step 6: Select the beneficiary details and click ‘Submit’

Step 7: Accept the terms and conditions, enter the transaction password and click on the ‘Submit’ option

Step 8: Verify the details and click on ‘Confirm’. The confirmation of the status of the transaction will be displayed on the screen

Details Required to Carry Out for a NEFT Transaction

Given below are some of the important details required to carry out for a NEFT transaction:

- Registered mobile number of the sender or remitter

- IFSC code of the payee’s bank

- Account details of the payee

- The amount of money to be sent

SBI NEFT Timings

At the Branch: NEFT payments can be made from 10 AM till 6 PM every Monday to Saturday (excluding 2nd and 4th Saturday, Sunday and other public or bank holidays). Please mention NEFT transfer at the back of the cheque, if making payments via cheque. Otherwise, simply drop your SBI NEFT form in the drop-box. If you deposit your cheque after the cut-off time, the transaction will be carried out the next day.

Online: SBI NEFT window is open round the clock, i.e. 24×7.

SBI Bank Timings

SBI or the State Bank of India is open every Monday to Saturday of every week (barring any bank/public holiday) with 2nd and 4th Saturday being the exceptions. The bank allows cash transaction till 3:30 PM.

Read More: SBI Bank Timings

SBI NEFT charges

As per the RBI directive, online NEFT payments do not carry any charges (done via mobile banking or internet banking). But, if done at the branch, the following updated SBI NEFT charges will be applicable as per the transaction amount:

| Transaction Amount | SBI NEFT Charges* – At the Branch | SBI NEFT Charges – via Netbanking/Mobile Banking |

| Up to Rs. 10,000 | Not more than Rs. 2.50 | NA |

| Above Rs. 10,0000 up to Rs. 1 lakh | Not more than Rs. 5.00 | NA |

| Above Rs. 1 lakh up to Rs. 2 lakhs | Not more than Rs. 15 | NA |

| Above Rs. 2 lakhs | Not more than Rs. 25 | NA |

Note: *(+ Applicable GST)

Important: The above-stated figures are as per the RBI guidelines updated as on 17th November, 2021.

SBI Credit Card Bill Payment through NEFT

SBI allows its customers to make their credit card bill payments using their NEFT window. All you need to do is follow the steps given below diligently to pay your credit card bills via NEFT:

Step 1: Go to SBI netbanking portal at Online SBI and login to your account using your username and password.

Step 2: Select “Third Party Transfer” from “Payments/Transfers”.

Step 3: Add SBI Card as Beneficiary.

Step 4: Enter SBIN00CARDS as the ISFC Code.

Step 5: Enter your 16-digit SBI card number where account number is to be mentioned.

Step 6: Select “Credit Card Payment” or “Savings Account” as Beneficiary Account Type.

Step 7: Add Bank Name as SBI CREDIT CARD – NEFT.

Step 8: Enter PAYMENT SYSTEMS GROUP, STATE BANK GITC, CBD BELAPUR, NAVI MUMBAI in the Add Bank section.

Step 9: Read the details and click on the “Submit” button.

Your credit card payment will reflect within 3 banking hours in your SBI credit card account.

Also check NEFT processes for other banks from the table below:

SBI NEFT – FAQs

No charges are levied on SBI NEFT payments when done using either netbanking or mobile banking. When done at the branch, you may be required to pay between Rs. 2.50 to Rs. 25 basis transaction amount.

NEFT payments at the branch of SBI can be done by 6PM of any working day. However, please contact your branch for any change in this time.

NEFT payments are cleared within 3 banking hours, when done in the branch. When done using the internet banking or mobile banking mode, it gets completed within 2 hours.

NEFT payments can be done using mobile banking SBI YONO App, netbanking via Online SBI and by simply visiting your nearby branch (preferably base branch). Online transactions can be done 24×7.

There is no minimum amount set for SBI NEFT payments.

The maximum amount that can be transferred using the SBI NEFT mode is Rs. 10 lakhs in a day (for retail customers).

If you’ve paid your SBI credit card bill using NEFT by 3.30 PM, the same will reflect in your SBI Card account within 3 banking hours on the same day.

NEFT stands for National Electronic Fund Transfer.