SBI Quick is the missed call banking app offered by the State Bank of India for its retail customers in India. Using SBI Quick, you may access various SBI personal banking services by giving a missed call or sending an SMS.

How to Use SBI Quick?

SBI Quick, as the name suggests, is a quick way of banking with SBI. You may use it for your SBI savings account related services, mobile recharge, debit card and more.

SBI Quick – Missed Call Banking

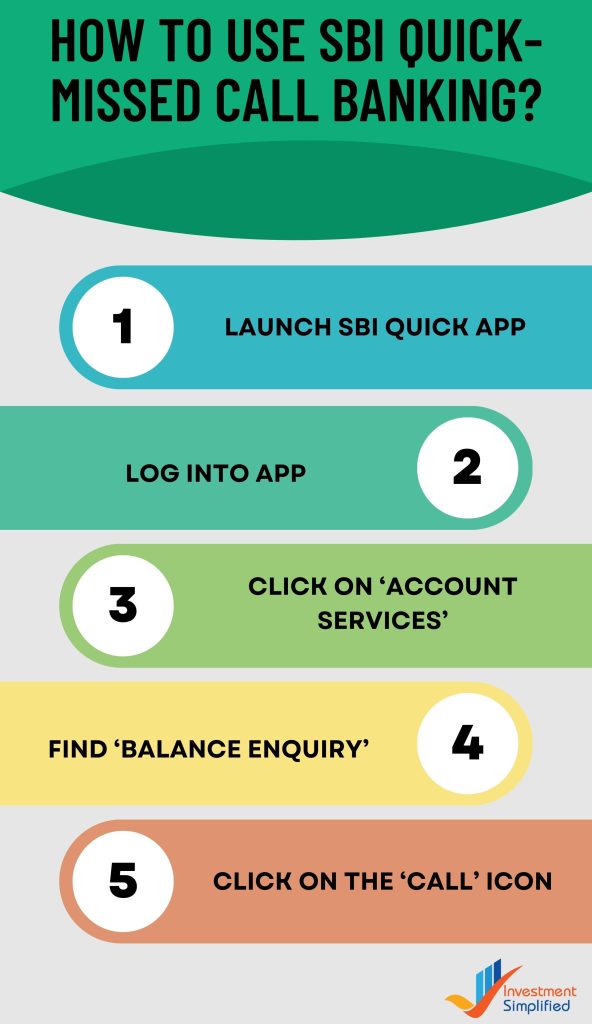

You can check your SBI account balance easily within seconds via the SBI Quick app. Steps for this are:

- Launch SBI Quick app

- Log in using either your SBI net banking credentials or fingerprint scan

- Click on ‘Account Services’

- Find ‘Balance Enquiry’

- Click on the ‘Call’ icon

A missed call will automatically be placed from your registered mobile number after which, you’ll receive an SMS with your SBI account balance.

Similarly, you may get your SBI mini statement via SBI Quick. Just click on ‘Call’ option next to the ‘Mini Statement’ button and that’s all.

SBI Quick – SMS Banking

For SBI balance check or to get SBI mini statement via SMS, SBI Quick app is highly convenient. Just follow these steps:

- Launch SBI Quick App and login

- Select ‘Account Services’

- Click on ‘Message’ icon next to Balance Enquiry or

- Select the ‘Message’ icon for the Mini Statement section

An SMS will be drafted automatically in your mobile’s default messaging app. You don’t need to type any specific code or add account details as the app is directly linked to your SBI savings account (or current account). Simply agree to send this SMS and once done, you’ll receive a reply in the same SMS trail with details about your SBI balance or mini statement (whichever option you chose initially).

How to Check SBI Holidays using SBI Quick?

Now, you can check the list of SBI Bank holidays any time and from anywhere using the SBI Quick app. This is how:

- Open the app

- Click on the ‘Holiday Calendar’ widget

- Select the area from ‘State/UT’ or ‘Circle’

- Select the Month and Year

After this, bank holiday calendar will be displayed and the holidays, if any in that particular month, will be highlighted with details given just below the calendar.

Services Offered on SBI Quick

SBI Account-related Services you may avail of using SBI Quick are:

- SBI balance check

- SBI mini statement

- Place request for cheque book

- Get SBI e-statement of 6 months

- E-Certificate for SBI home loan & education loan

SBI Debit Card-related services on SBI Quick:

- Block SBI debit cum ATM card

- Manage international/domestic usage of SBI debit card

- Generate SBI debit card green PIN

Miscellaneous Services on SBI Quick

- Mobile top-up or recharge

- Mobile post-paid bill payments

- Subscribe to PMJJBY and PMSBY (PM social security schemes)

SBI Quick: FAQs

You may transfer an amount up to Rs 25,000 in a single transaction using SBI Quick. Transfer limit is the same for per day transaction.

Launch the SBI Quick App > Account Services > Loans > Apply for Loans.

Send this SMS: ‘REG Account Number’ to 07208933148 to register for the SBI Quick services. Once done, your registered mobile number will be linked to the app and you may use it for the services listed in the app.

Yes. Your mobile number must be registered and linked to your SBI account and SBI Quick service for using the app.

Yes, you can use the SBI Quick app in many Hindi, Marathi, Punjabi, Bangla, Tamil, Malyalam, Gujarati, Konkani and many other languages. English is the default language when you use the app for the first time. However, you may change the language anytime easily within the app.

You may enquire about the SBI personal loan on the SBI Quick app along with other types of loans like home loan, car loan, gold loan, education loan and more. Also, when you go to the Loans section, you can choose the ‘Apply for Loan’ option and proceed from there.

Yes. You can check your account balance using the SBI Quick app.