What is EPF? Simply said, EPF is a retirement benefit scheme rolled out by the Government of India to provide socio-economic security to the employees when they retire from their jobs. It is applicable to those working in private and public sector, both.

Under this scheme, a predetermined amount (12% or 10% of basic salary + DA) is deducted from the employee’s basic salary and submitted to the employee’s provident fund. The employer also makes the equal contribution to the same fund.

Let’s know more about the Employee’s Provident Fund in the article further.

| Important Notice: As of 1st June 2021, it is mandatory to link your EPF account with your Aadhaar. EPF contributions will not be credited to the accounts not linked with Aadhaar. |

EPF Interest Rate 2021-22

EPF rate of interest for 2021-22 and interest rate for the last 10 years is tabulated below:

| Financial Year | Rate (in %) |

| 2021-22 | 8.10 |

| 2020-21 | 8.50 |

| 2019-20 | 8.50 |

| 2018-19 | 8.65 |

| 2017-18 | 8.55 |

| 2016-17 | 8.65 |

| 2015-16 | 8.80 |

| 2014-15 | 8.75 |

| 2013-14 | 8.75 |

| 2012-13 | 8.50 |

| 2011-12 | 8.25 |

Types of EPF Schemes

Employee’s Provident Fund is classified into two schemes, viz.:

- Employee’s Provident Fund Scheme (1952)

- Employee’s Pension Scheme

- Employee’s Deposit Linked Insurance or EDLI (1976)

Know all about EPF Registration Process and EPFO Member Login

What is UAN?

Full form of UAN is Universal Account Number. UAN is a 12-digit number which is allotted to every employee registered with the Employee’s Provident Fund Organisation or EPFO. To log into EPFO member portal, UAN is required in combination with the EPGO login password. Without UAN, employees cannot avail EPFO online services.

EPF Contribution

Present rates for PF contribution are as tabulated below:

| Contribution by: | Contribution to EPF | Contribution to EPS | Contribution to EDLI |

|---|---|---|---|

| Employee | 12% or 10%* | – | – |

| Employer | Employee (EE) Share ‘less’ EPS contribution 1st Case: (12% – 8.33%) Or 2nd Case: (10% – 8.33%) | 8.33% | 0.5% |

*10% rate applicable to:

- Establishment with less than 20 employees, or

- Establishment with losses equal to or more than its net worth, or

- Establishment in the following industries:

- Jute

- Beedi

- Brick

- Coir

- Guar Gum

**Administration charges of 0.5% deducted from the employer’s share

EPF Benefits

The following are the key benefits of EPF scheme that make it an attractive retirement benefit-cum-scheme for the salaried individuals:

- Financial Security

Money deposited in provident fund cannot be withdrawn for a period of 15 years unless there’s an emergent situation like a medical illness, employment termination or death of account holder. This ensures long term savings.

- Retirement Cushion

Salaried individuals registered under the Employee Pension Scheme, a sub-division of the Employee Provident Fund, get their retirement fund through the EPF contributions made by their employer.

- In case of physical disability/death of account-holder

Funds in PF account can be used if the accountholder is no longer physically enabled to continue with their job. If the accountholder dies before retirement, the amount can be utilized by the nominee.

- Life Insurance Coverage

Under the EDLI or Employee Deposit Linked Insurance scheme (sub-type of EPF), employee is provided life insurance cover. This is funded through the employer’s contribution (0.5% of contribution) towards EPF.

- Tax-Saving

EPF deposits as well as the interest earned on it – both are exempt from tax u/s 80 C of the IT Act, 1961. This especially helps those in mid-income group to save taxes. However, if contributions towards EPF (and VPF – Voluntary Provident Fund) are more than Rs 2.50 lakhs (in FY), interest earned on PF will be taxable.

Form 15G for EPF proceeds: When withdrawing EPF funds, you can fill and submit Form 15G so that interest on EPF proceeds is not deducted, i.e. to save TDS. This way, you can settle your taxes directly at the time of filing your Income Tax Return, instead of adding one more step to ask for refund on TDS. Also, please note that if you are above 60 years of age, you need to submit Form 15H instead of 15G. It will serve the same purpose of saving TDS.

EPFO Eligibility Criteria

- EPF eligibility for employers

- Employees with basic salary (plus dearness allowance) less than Rs 15,000 per month are mandatorily required to register for EPF scheme

- Employees with basic salary (plus DA) more than Rs 15,000 can volunteer for EPF

- EPF eligibility for Employers

- Establishment with 20 employees or more has to compulsorily register with EPFO

EPF Withdrawal Rules: 2021-22

Employees can partially or fully withdraw their EPF funds basis various situations, viz.:

- After the age of 54 years: 90% EPF withdrawal allowed

- Upon unemployment of 1 month or more: 75% of PF withdrawal allowed (remaining 25% in next month of unemployment)

- Housing Loan/Purchase of house/flat or for housing loan repayment

- Lockout or closure of factory

- Medical reasons (illness of family or self)

- Marriage of self/children/siblings

- Educational purposes

- For investment in Varishta Pension Bima Yojna

- If member has left changed company

- If member has left one organization but not joined another

The following EPF forms are needed for the above-stated EPF withdrawal situations:

- Pension Claim Form

- Composite Claim Form

- Form 13

- Form 10D (for monthly pension)

- Form 20D (for final settlement of PF)

All these forms are available at the EPFO website and Umang mobile app, both.

Read More: How to Withdraw Pension Contribution in EPF?

EPF Passbook: How to Download?

What is EPF Passbook?

EPF passbook is like a journal in which all the entries (deposits and withdrawals made to the PF account) are documented. Please note that if you have more than one EPF member IDs, every Member ID will have a separate EPF passbook.

EPF Passbook can be downloaded online from either the EPFO Member Passbook page or from the Umang mobile app.

How to Download EPF Passbook via EPFO Member Portal

- Sign in to EPF Member Passbook portal using your UAN and Password.

2. Click on “Select Member ID”.

3. Choose the Member ID for which you want to download the EPFO passbook.

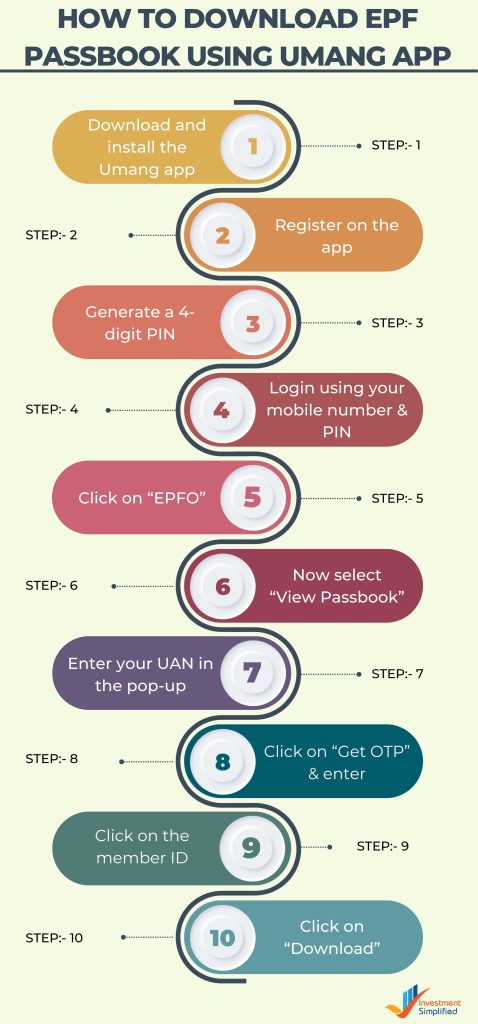

How to Download EPF Passbook using Umang App

- Download and install the Umang app from Play Store or App Store.

2. Register on the app using your mobile number and generate a 4-digit PIN.

3. Login using your mobile number and PIN.

4. Click on “EPFO”.

5. Now select “View Passbook”.

6. Enter your UAN in the pop-up form and click on “Get OTP”.

7. Enter the OTP receiver on your mobile number.

8. List of all member IDs will be displayed. Click on the member ID for which you want to get the PF passbook for.

9. Scroll to the bottom of the page and click on “Download” to get this passbook downloaded on your device.

| Read more about EPF: | ||

| EPF Balance Check | EPF Correction Form | EPF Passbook |

| EPF Calculator | EPF Interest Rate | EPF Pension |

| EPF Contribution | EPF Online Claim | EPF Premature Withdrawal |

| Read more about UAN: | ||

| UAN | UAN Activation | |

| Read more about EPFO: | ||

| EPFO E-Sewa | EPFO Online Payment | EPFO KYC Online Update |

| EPFO Establishment | EPFO Member Portal | EPFO Registration Process |

| Read more about EPF Forms: | ||

| EPF Form 10C | EPF Form 19 | EPF Withdrawal Form 31 |

Employee’s Provident Fund: FAQs

EPFO full form: Employee’s Provident Fund Organisation.

There is no difference between EPF and PF. EPF or Employee’s Provident Fund is commonly referred to as PF or Provident Fund also.

UAN passbook is like a register in which all the contributions made to the specific UAN are listed. Just like your bank account statement, UAN passbook is a statement of your EPF balance. You can login to EPFO member portal and view their UAN passbook to check EPF balance.

Yes, PF contribution is calculated as 12% of (Basic Salary + Dearness Allowance). However, that said, DA is applicable only for the government employees while those working in private establishments generally do not get any dearness allowance and thus for them, it is 12% of Basic Salary only.

No. As an employee working in a registered establishment, your PF account is mandatorily created. Under this account, you get insurance coverage as Employee’s Deposit Linked Insurance scheme or EDLI. 0.5% of the employer’s contribution for EPF is directed towards EDLI.