If you are involved in the sale of goods and/or services with an annual average turnover of Rs 40 lakhs or more (different for north-eastern states and few other hilly areas), you are required by law to initiate GST registration.

GST registration can easily be done online at the gst.gov website. In this post we talk about how to apply for GST registration, eligibility criteria, documents required for GST registration & more.

Know in Detail: What is GST?

How to register for GST?

You can apply for GST registration online using the GST web portal. In this mode, there is no need for a physical application. The following section talks about how to apply for GST registration:

Step 1: Go to the GST web portal.

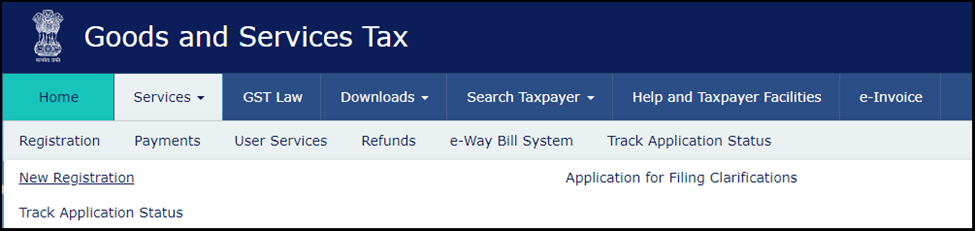

Step 2: Click on “Services” and then select “New Registration” under the “Registration” section.

Step 3: Fill the online form that’ll open next. (refer image given above)

Step 4: Click on “Proceed” and follow the steps as they appear next on your screen to complete the GST registration.

Upon successful application of GST registration, an ARN (Application Reference Number) will be generated and sent to your email ID and mobile number. This will be used to track application status later.

Also Read: GST Login Process

GST Registration Fees

Wondering about the fee to be paid for GST registration? Here’s a good news – there is no GST registration fees. Yes. Be it for a normal taxpayer like HUF, company, LLP, partnership firm, etc. or a GST Practitioner/Tax Deductor at Source, you do not need to pay anything for registering under GST and getting a GST number/GSTIN.

Who should register for GST?

Eligibility criteria for GST registration:

- Businesses registered under the old tax regime (VAT, excise duty and/or service tax)

- Any business involved in inter-state supply of goods and/or services

- Business involved in sale of goods/services within state

- Casual taxpayers

- Taxpayers under Reverse Charge Mechanism

- Businesses under the e-commerce category

- Input service distributors

- Tax Deductor at Source

Note: This is not an exhaustive list.

The following persons are included in the definition of a taxable person:

- Individual

- HUF

- Company

- Firm

- Limited Liability Partnership (LLP)

- Local authority

- Co-operative society,

- Trusts

- Association of Persons or Body of Individuals (AOP/BOI)

Documents required for GST registration

The following list of documents must be checked when applying for GST registration online:

- PAN

- Documentary proof of constitution of your business

- Documentary proof of promoters or partners

- Documentary proof of principal place of business

- Details of additional place of business (if any)

- Details of Primary Authorised Signatory

- Details of Authorised Signatories (with photos and proof of appointment)

- Bank account details of business

- Bank statement or first page of passbook

- Photographs of the business owners/partners in PDF or JPEG format (not exceeding 1 MB)

(All the documents must have a file size of 1MB or less. For bank statements or passbook, it should be 500KB or less)

Note: This is not an exhaustive list.

How to Track GST Application Status?

Follow the steps given below to check the status of your GST application online:

Step 1: Visit GST web-portal at gst.gov.

Step 2: Click on “Services”.

Step 3: Select “Track Application Status”.

Step 4: Select “Registration” from the drop down list. (refer the above image)

Step 5: Enter your ARN or Application Reference Number.

Step 6: Hit the “Search” button to know the current status of your GST registration application.

GST Registration: FAQs

There is no fee for GST registration.

Yes. Furnishing PAN is mandatory when applying for GST registration.

No, since the new GST registration is totally paperless, there is no need to provide any hard copies.

To sign the application for GST registration online, you need to get Digital Signature Certificate or opt for Aadhaar based e-Sign facility.gh the portal, the entire process is free of cost.

Yes. An existing taxpayer can get their Aadhaar authenticated by e-KYC or by opting for Aadhaar authentication link.

Read More: How to Save Tax