Axis Bank is a reputable banking institution known to provide a wide range of offerings and options in their saving account types to fulfil the diverse requirements of their diverse customer groups. Irrespective of your age, employment status or income group, Axis bank has offerings which will match your requirements and provide you with services based on your requirements. In this particular article we will delve deeper into the Axis Bank Savings Account, benefits, features, Axis Bank Savings Account Opening, Axis Bank Savings Account Interest rates and other necessary parameters which shall help in you making the right decision.

Axis Bank Interest Rates On Savings Account:

Here’s the list of interest rates for Axis Bank Savings Account based on the type of account you have:

| Account Balance | Applicable Rate of Interest w.e.f. 1st Jun, 2022 |

| Less than Rs 50 Lakhs | 3.00% p.a. |

| Rs. 50 Lacs and up to less than Rs. 800 Crs | 3.50% p.a. |

Disclaimer: Interest rates are subject to changes. Please check the official bank website for the most recent data.

Types of Axis Bank Savings Account

Axis Bank is known to provide various options for savings account based on the needs and preferences of their customers. Some of them are:

Axis Bank Digital Savings Accounts

1. Easy Access Digital Savings Account

- Can be opened online

- Minimum Balance Requirement: Rs 12,000 (Metro/ Urban) + Rs 5,000 (Semi-Urban) + Rs 2,500 (Rural)

- Instant E-Debit Card is provided to users

- Eligibility: Any Indian citizen above the age of 18 years applying from India

2. Liberty Digital Savings Account

- Can be opened online

- Rs 25,000(Metro/Urban) or spends of Rs. 25,000/-, Rs. 25,000 (Semi-urban/Rural – AMB or spends of 25,000/-)

- Instant E-Debit Card is provided

- Eligibility: Any Indian citizen above the age of 18 years applying from India

3. Prestige Digital Savings Account

- Can be opened online

- Initial Funding Balance must be Rs. 75,000 /-

- Average Quarterly Balance must be Rs. 75,000 /-

- Instant Axis E-Debit card is provided

- Eligibility: Any Indian citizen above the age of 18 years applying from India

4. Priority Digital Savings Account

- Can be opened online

- Initial Funding – ₹ 2 Lakhs

- Average Quarterly Balance Requirement – ₹ 2 Lakhs

- Instant Axis E-Debit Card is provided

- Complimentary Access to airport lounges

- Eligibility: Any Indian citizen above the age of 18 years applying from India

5. Burgundy Digital Savings Account

- Can be opened online

- Initial Funding – ₹ 5 Lakhs

- Average Quarterly Balance Requirement – ₹ 10 Lakhs

- Instant E-Debit Card is provided

- Complimentary Access to Airport Lounges

- Eligibility: Any Indian citizen above the age of 18 years applying from India

Other Axis Bank Savings Accounts

6. Sahaj Savings Account

- Provided a Platinum Debit Card

- Comes with a daily ATM withdrawal limit of Rs. 40,000

- Can be opened through Ekyc

- 1 Multicity Cheque book is provided

- Zero Balance Requirement

- Can be opened only through select business correspondents

- Any individual residing in India is eligible

7. Government Scholarship Savings Account

- Comes with a RuPay Platinum Debit Card

- Daily ATM Withdrawal Limit is set at Rs. 40,000

- Unlimited Free Cash Deposits and 4 Free Withdrawals Per Month

- Zero Minimum Balance

- Eligibility – Any Indian Citizen Residing in India without any existing savings account in Axis Bank. Must be the recipient of any government scholarship.

8. Easy Access Savings Account

- Comes with a Secure Plus Debit card

- Allows for a Daily ATM withdrawal limit of Rs. 50,000

- Provides with 1 Multicity Chequebook every year

- Nominal Minimum Balance

- Eligibility – Any Individual Residing in India or a Hindu Undivided Family

9. Liberty Savings Account

- Comes with an Instant Virtual Debit Card and Liberty Debit Card

- Provides for a flexibility to either maintain or spend Rs. 25,000 per month

- Eligibility: Individual Residing in India or an HUF

10. Prestige Savings Account

- Comes with a Prestige Cashback Debit Card

- Has a Daily ATM Withdrawal Limit of Rs. 1,00,000

- Provides for unlimited chequebooks and unlimited branch transactions

- Eligibility – Individual Residing in India or an HUF

11. Senior Privilege Savings Account

- Comes with a Visa Platinum Debit Card

- Has a daily ATM withdrawal limit of Rs 40, 000

- One free multicity chequebook per year

- Provides for discounts at healthcare services

- Eligibility- Individuals above 57 years of age

12. Future Stars Savings Account

- Comes with a Visa platinum debit card

- Has a daily ATM withdrawal limit of Rs 1,500 and a daily shopping limit of Rs 1, 000

- One multicity chequebook every year

- Eligibility- Minor below 18 years of age, Parents/guardians must have an Axis Bank Savings Account

13. Pension Savings Account

- Comes with a visa classic debit card

- Has a daily ATM Withdrawal Limit of Rs 40,000

- Provides for Free Unlimited Multicity Chequebooks

- Eligibility- Employees of Central Government and civil ministries covered under the Central Government Civil Pension Scheme operated by Central Pension Accounting Office, Department of Expenditure and Ministry of Finance, Employees of the armed forces (Army, Navy and Air Force) under Ministry of Defence covered under the Defence Pension Scheme operated by Pension Sanctioning Authority/Defence Unit., Employees of an establishment with a workforce strength of more than 20 (including contract employees), who have opted to be members of the EPS 95 scheme, Existing members of ‘Member of Employees’ Family Pension Scheme

14. Insurance Agent Account

- Comes with a Visa Classic Debit card

- Has a daily ATM withdrawal limit of Rs 40,000

- Provides with 1 free multicity chequebook per year

- Eligibility – Resident Citizen of Indi, must be an Insurance Agent

15. Basic Savings Account

- Provides a RuPay debit card

- Has a daily ATM withdrawal limit of Rs 40,000

- It is a zero balance savings account

- Eligibility – an Individual residing in India with no existing Axis bank account

16. Small Basic Savings Account

- Comes with a RuPay debit card

- Has a daily ATM withdrawal limit of Rs 40,0000

- Free Cash deposits

- Zero minimum balance

- Eligibility – an Individual residing in India of min. 18 years old with no other Axis Bank Account

Axis Bank Zero Balance Savings Account

Axis Bank surely provides options for zero balance savings accounts. Customers can create a zero balance savings account, like the Axis ASAP account, using the mobile app using only their PAN and Aadhaar card information. Similar zero balance savings accounts are provided by Axis Bank, including “Axis Pension Savings Account” and “Axis Women’s Savings Account”. It’s important to consider that Axis Bank’s other savings accounts can have certain minimal balance restrictions.

Features of Axis Bank Savings Account

The following are the prime features of an Axis Bank savings account:

- Provides for multiple kinds of accounts and a range of choices for an informed consumer to decide from

- Multiple kinds of banking methods are provided ranging from mobile banking, internet banking, app based banking etc.

- In certain account types, free chequebooks are issued too

- Options for free online cash transfers, such as NEFT, RTGS, IMPS, and UPI

- Specialised interest rates for young people and senior citizens

- On some account types, personal accident insurance provides coverage up to Rs. 2 lakhs

- A zero contact debit card option is also provided to ensure hassle-free transactions

- Free withdrawals of cash from a few Axis Bank and other partner banks’ ATMs

- A simple nomination process to guarantee a seamless account transfer in the event of any unforeseen circumstances

- Regular email and SMS updates and notifications on account balance and transactions

Note: The eligibility criteria and other details may vary based on the specific savings account variant chosen by the customer.

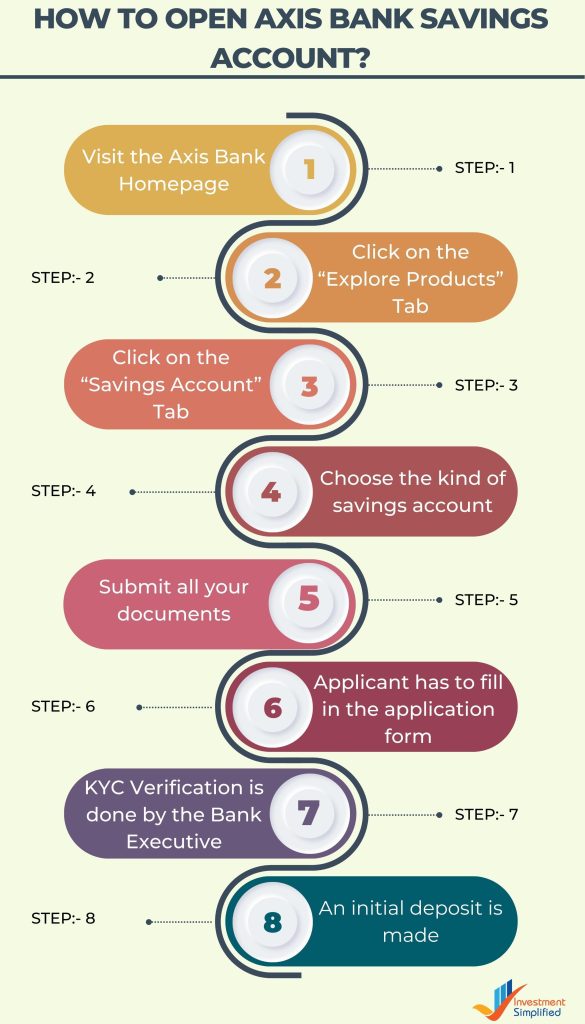

How to Open Axis Bank Savings Account?

The following are the steps to open an Axis Bank savings account

Step 1: Visit the Axis Bank Homepage

Step 2: Click on the “Explore Products” Tab and then click on the “Savings Account” Tab

Step 3: Choose the kind of savings account that fits your needs

Step 4: After applying, an executive from the bank shall approach you for submission of documents

Step 5: Applicant has to fill in the application form.

Step 6: KYC Verification is done by the Bank Executive

Step 7: Depending on the minimum balance requirement, an initial deposit is made

How to Open an Axis Bank Savings Account Online (Axis Asap)?

Axis Bank offers the option of online account opening in its savings account variant of “Axis ASAP”. To open an Axis ASAP account online, follow these steps:

Step 1: Get the Axis Bank mobile app from the Google Play Store or the App Store.

Step 2: Click “Open Axis ASAP account” after starting the programme.

Step 3: Type in your cell number and validate it using the OTP that was delivered to your phone.

Step 4: Finish the video KYC procedure by entering the information from your PAN card and Aadhaar number.

Step 5: After the KYC is through, choose the Axis ASAP account type you want to open.

Step 6: Enter the necessary contact and personal information, such as name, address, email address, and occupation.

Step 7: Create your debit card PIN and MPIN.

Step 8: Thoroughly review the application provided by you so as to ensure compliance and then proceed to submit the application.

Step 9: The initial deposit amount specified by the bank must be deposited by you into the bank account after its creation through various available methods like net-banking or UPI.

Step 10: Your Axis ASAP account will be promptly authorised, and you will get the account number, information for your virtual debit card, and other pertinent information via the app.

Note that the Axis ASAP account is available to new customers only who have not held a savings account with Axis Bank before and is subject to eligibility criteria and terms and conditions

Documents Required for Axis Bank Savings Account:

The following paperwork is normally required in order to open a savings account with Axis Bank:

1. Government-issued identification documents like as an Aadhaar card, passport, voter ID card, driver’s licence, or PAN card may be used as proof of identity.

2. Aadhaar cards, passports, voter identification cards, driver’s licences, utility bills (electricity, water, gas), or bank statements are all acceptable forms of proof of address.

3. A photograph the size of a passport.

4. PAN card (or Form 60/61 in the absence of a PAN card)

Customers must take a note of the fact that different additional documents may be required for specific types of accounts. Therefore, it is always advisable to contact the bank for more specific details to stay informed and prepared.

Who Can Open an Axis Bank Savings Account?

The below-stated constitutes as the eligibility criteria for opening an Axis Bank savings account:

- Axis Bank allows qualified NRIs, HUFs, and resident Indians to open savings accounts.

- The account holders must be of 18 years of age, meaning they must have attained majority.

- Individuals who have not attained the age of 18 or are legally minors, enjoy the option of opening an account with their parents or legal guardians.

- Enterprises, corporations, businesses, partnerships, estates, sole proprietorships and other body corporates also have an option to open accounts with Axis Bank.

- The individual wishing to open the account must fulfil the criteria’s set by Reserve Bank of India and must provide the requisite address proof.

Benefits of Axis Bank Savings Account

There are multiple advantages that are provided to the customers by Axis Bank on opening a savings account, they are:

1. Multiple and wide range of account options are provided by Axis Bank based on the demands, needs, requirements of various groups of customers.

2. Competitive interest rates: Axis Bank provides savings account clients attractive interest rates that enable them to build their investments over time.

3. Convenient access: Customers may easily access their accounts and conduct transactions thanks to Axis Bank’s extensive network of branches and ATMs around the nation.

4. Online banking options: Customers may easily access their accounts using Axis Bank’s internet banking and mobile banking platforms from any location at any time. Through these platforms, customers may conduct a variety of activities, including fund transfers, bill payments, generating debit card PIN and more.

5. Extra features and benefits: Depending on the kind of savings account, Axis Bank provides a variety of extra features and advantages, like free ATM transactions, cashback deals, discounts on eating and shopping, and more.

6. Special perks and features catered to their requirements are available with Axis Bank’s customised solutions for several consumer categories, including women, young people, and older folks.

Overall, opening a savings account with Axis Bank can provide customers with a range of benefits and help them meet their financial goals

Axis Bank Savings Account Vs. Current Account – Differences

The main differences between an Axis Bank savings account and current account are as follows:

1. Function: A current account’s function is to ease daily transactions for businesses and individuals who have regular transactions, whereas a savings account’s function is to save money and earn interest on it.

2. Minimum balance restrictions: Current account minimum balance requirements are often greater than those for savings accounts.

3. Interest rates: Because the money put in a savings account is intended to be saved for a longer length of time, savings accounts often yield greater interest rates than current accounts. Contrarily, current accounts often don’t pay interest because the money in them is intended for frequent debits and credits and not for the purpose of saving.

4. Withdrawal limitations: Unlike current accounts, savings accounts may have limitations on the number of withdrawals that may be made each month. This is so because current accounts, which call for flexibility when it comes to withdrawals, are made for frequent transactions.

5. Current accounts generally have overdraft privileges, which let people and corporations withdraw more money than their available amount. This is not typically available with savings accounts.

To conclude, it is wise to note that the reasons why savings account and current account are used are quite different from each other. Beneficiaries use the account for various purposes and for their unique features. It is advisable to customers to check which type of account fulfils their requirements and needs and select the type of account based on those parameters.

Tabular Comparison for Axis Bank Savings Account & Current Account

| FEATURES | SAVINGS ACCOUNT | CURRENT ACCOUNT |

| Purpose | PERSONAL | BUSINESS |

| Interest Rate | Usually Higher | Usually Lower |

| Minimum Balance | Required (in some) | Required (in some) |

| Overdraft | Limited | Can be availed with interest |

| Transaction Fees | Usually low | Usually high |

| Cheque Book Issuance | Complementary | Can be purchased |

| Cash Deposit/ Withdrawal | Complementary | Usually free for specific amounts |

| Online Banking | Available | Available |

How to Transfer Funds from Axis Bank Savings Account?

You can transfer funds from your Axis Bank savings account through various methods:

1. Online Fund Transfer: Using the Axis Bank Mobile Banking or Internet Banking services, you can transfer money from your Axis Bank savings account to another Axis Bank account or any other bank account.

2. NEFT/RTGS/IMPS: Additional methods for transferring money include Axis NEFT (National Electronic Funds Transfer), RTGS (Real Time Gross Settlement), and IMPS (Immediate Payment Service). These particular services can be enjoyed by multiple modes.

3. ATM Transfer: The Axis Bank Debit Card which is provided to the customer after opening the account can be used for transferring funds from your own account to another account of the same bank as well as of another bank. You simply need to insert the ATM Debit card in the machine, enter your confidential pin-code and select the option of “Fund Transfer” after which the machine will display instructions that you need to follow to initiate and complete the action.

4. Cheque Transfer: Another option for transferring money is to write a cheque that is drawn on your Axis Bank savings account. Either deposit the check in the beneficiary’s account yourself, or give the beneficiary the cheque so they may deposit it themselves.

Be aware that some of these methods could include fees like NEFT charges, RTGS charges and so on, and the fees might change based on the amount of the transfer and the chosen method. Before beginning a fund transfer, it is essential to inquire with the bank about any relevant fees.

How to Transfer Funds Online from Axis Bank Savings Account?

You can transfer funds from your Axis Bank savings account online through the following steps:

Step 1: Login to your Axis Bank netbanking account using your customer ID and password.

Step 2: In the dashboard section, you need to simply click on the “transfer” option.

Step 3: Then you need to choose the type of transfer that you want to initiate which includes: RTGS, NEFT or IMPS.

Step 4: The beneficiary’s details are to be typed by you which shall include their name, account number and bank IFSC Code.

Step 5: You need to type in the amount of money that you wish to transfer and then select your account from which you want to transfer the money.

Step 6: You need to read through the details again to check their accuracy and then press on “Transfer” to start the process.

Step 7: Once the process is done, you shall receive a text message on your registered mobile number intimating you regarding the transfer being done and providing you with a transfer number.

You must have a mobile number registered and linked to your bank account to avail the services of net-banking as all the updates and notifications will be received on the provided number directly.

Customer Care

You may get in touch with Axis Bank customer support using any of the following methods if you have any questions or concerns regarding your savings account:

1. Axis Bank Missed Call: From your registered cell number or any other number, dial 1860-419-5555 or 1860-500-5555 to reach Axis Bank customer service.

2. Axis Bank Email: You may also contact customer support by email at customer.service@axisbank.com with any questions or grievances.

3. Axis Bank SMS: You can send an SMS as “BAL<space>Account Number” to +91 8691 00 00 02 to check your Axis Bank savings account balance within minutes.

4. Axis Bank Branch: You can speak with a customer service representative in person by going to the nearby Axis Bank branch.

Read More: Axis Bank Customer Care

To get a quicker response to your question or complaint, please have your account number and other pertinent information on hand when calling Axis Bank customer service.

Axis Bank Savings Account: FAQs

Currently, Axis Bank is offering 3.00% and 3.50% interest on its savings account variants basis the account balance.

Yes, Axis Bank offers its digital savings accounts that can easily be opened online via video KYC.

No. An individual must be at least 18 years old to open a basic Axis Bank small savings account. For minors, there is Axis Future Star Savings account that can be opened by kids under guardian/parental guidance.

Yes. PAN card is an important document. However, if you do not own one, Form 60/61 may also be accepted to open a savings bank account.

Aadhaar is mandatory for opening a digital savings account online. Otherwise, it’s not compulsory.

Yes. You can deposit money into any bank which was registered as a Bank and regulated by RBI.