What is the primary objective of buying a life insurance? Is it investment? Is it tax saving? No, the primary objective of a life insurance is to cover your loved ones in your absence. While the emotional dent takes its own due course, the financial crunch can be well managed if you took a good life insurance policy for a considerable sum assured. But, what if the claim gets rejected? Does it happen? Why would your life insurance company reject your claim? After all that’s why the policy was taken in the first place, right? Let’s understand this in detail.

What is Claim Rejection?

Claim rejection of an insurance policy – a life insurance policy – is when the nominee makes the claim to the insurer after the death of the policyholder and the insurance company rejects or declines this claim.

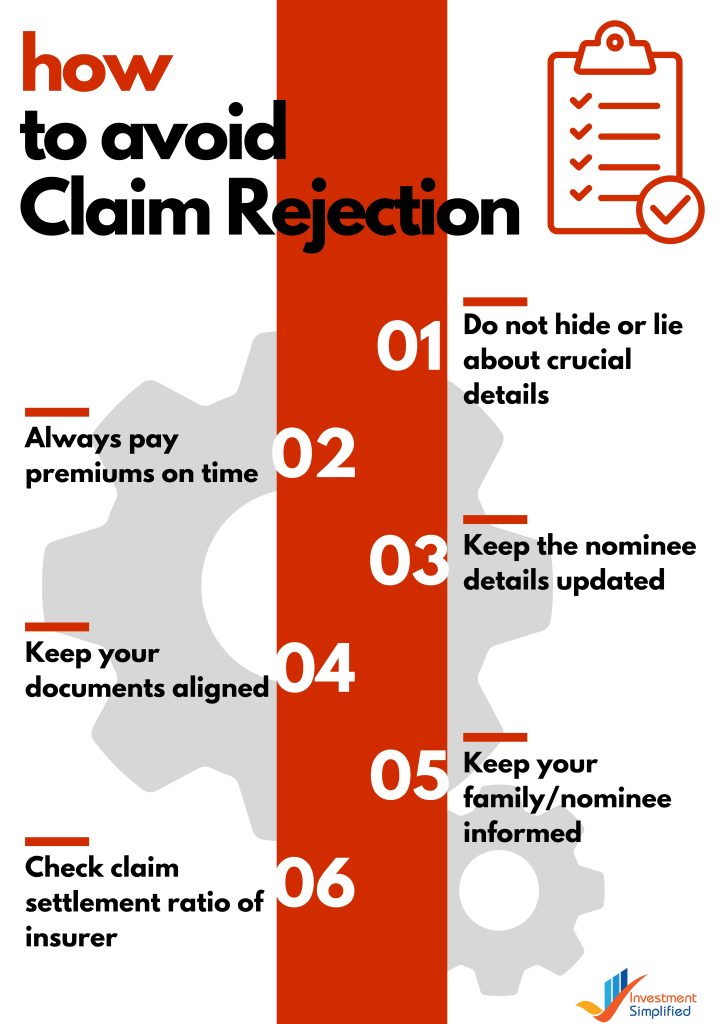

How to Avoid Claim Rejection of a Life Insurance Policy?

To avoid such an unpleasant situation of life insurance claim rejection, the following points must be well taken care of:

Do Not Hide or Lie About Crucial Details

At the time of buying the policy, you must not hide crucial details from your insurance company. These details can be an existing ailment or a hereditary disease in the family, lying about your smoking habits, your age or weight, etc. Sometimes people also misinform about their income as a higher income might lead to a higher coverage amount.

Additionally, there are certain jobs that come with significant occupational hazards. A person with a risky job might be charges with a higher premium. To avoid paying a higher premium, people sometimes end up lying about the same.

Any of such situations will lead to a straightaway decline of policy claim.

Pay Premiums on Time – Always

Premium is the cost of your life insurance policy. If you do not pay the cost of a product or service in time or in full, of course the same will not be offered to you. Thus, it is of high importance that you pay your life insurance premiums on time –always. You may ask for a premium break, if your policy has this option. Under this option, you can take a break from paying the premium for a short period of time, due to financial crunch or some other emergency.

Also, you may opt for limited premium payment option (e.g. limited pay option provided by Max Life Insurance on their Term Insurance Plan) instead of a regular one, if you do not wish to pay the premiums throughout the policy tenure.

Please check these things with your life insurer in detail before finalizing the policy.

Keep the Nominee Details Updated

Nominee is the person who will get the coverage amount after your demise. If this detail is not properly mentioned in your policy or is not updated, this will create a lot of tensions for your family. Ultimately, there are thick chances of the claim being rejected. Therefore, it is imperative that you keep the nominee details updated in your policy details.

Keep Your Documents Aligned

Sometimes we see discrepancies in our documents such as different date of birth in two certificates or varying name spellings. Especially in the case of females, this happens quite often because after getting married, many females change their surnames to their husband’s. This leads to a difference in names.

It is of extreme importance that you keep your documents updated. In case your name has changed due to marriage or any other reason, please update the same across your documents. Similarly, with the case of address. Any such misinformation can lead to your life insurance claim getting denied.

Keep Your Family/Nominee Informed

Buying a life insurance policy serves no purpose if the claim is not made in time. We read it every now and then that ‘Insurance is a subject matter of solicitation’. If you do not solicit, i.e. if you do not file for the claim within the stipulated time, the whole idea of insurance goes to the dump. Therefore, please keep your family/nominee informed about your life insurance policy and also about when and how they are supposed to inform the insurance company and file the claim. The claim must be made AS SOON AS POSSIBLE.

Contest period: Insurers can reject a claim if the policyholder dies within two years of taking the policy. If the insured dies during this two-year period, insurers review your coverage for misrepresentations during the application process before processing the claim.

Exceptional cases

Apart from the above-mentioned situations and circumstances, there are some other cases as well where the insurance company will not pay the coverage amount. This includes death of the policyholder by suicide, homicide, terrorist attack, natural disaster and voluntary involvement in hazardous activities etc. Also, if the policyholder passes away within 2 years of buying the life insurance policy, the company has the option to contest or question this claim. Extra digging is done to find out the cause of death. However, if nothing wrong is found, payout takes place as usual.

Check Claim Settlement Ratio of Insurer

Apart from all these points, it is imperative that you go for an insurance company that has a high claim settlement ratio. In India, currently Max Life Insurance has the highest claim settlement ratio of 99.51% in FY 2022-23. This means that almost all of the claims that were filed by the Max Life clients were paid in full. So, choose a company which has a good track record and enjoys the trust of its clients.

Take care of the information provided above, do not hide or manipulate information, be true to your insurer, pay premiums on time and keep the nominee details along with the other important details updated and the chances of your policy claim rejection will become slimmer than ever.

Best Ways To Avoid Life Insurance Claim Rejection: FAQs

Your term plan claim can be rejected due to these reasons: non-payment of premiums, nominee details missing or not updated, vital information like smoking habits hidden from the insurer and claims placed after the stipulated time etc.

You can avoid getting your life insurance claim rejected by following these practices: providing complete and correct information to the insurer, updating nominee details as and when needed, updating correspondence as and when required, paying premiums on time with no lapse, keeping your documents aligned and updated, etc.

A higher claim paid ratio indicates that there are less chances for your life insurance claims to get rejected. So one of the easy ways to avoid claim rejection is to check your chosen insurer’s claim paid ratio. If it’s a higher number, like the Max Life’s 99.51%, go for it. Else, re-consider.