The most secured type of cheque is an account payee cheque. Such cheques are issued in the name of the payee and such cheques cannot be encashed, i.e. the bank can only transfer the amount mentioned on the cheque in the bank account of the payee.

Let’s know more about an Account Payee Cheque in this post.

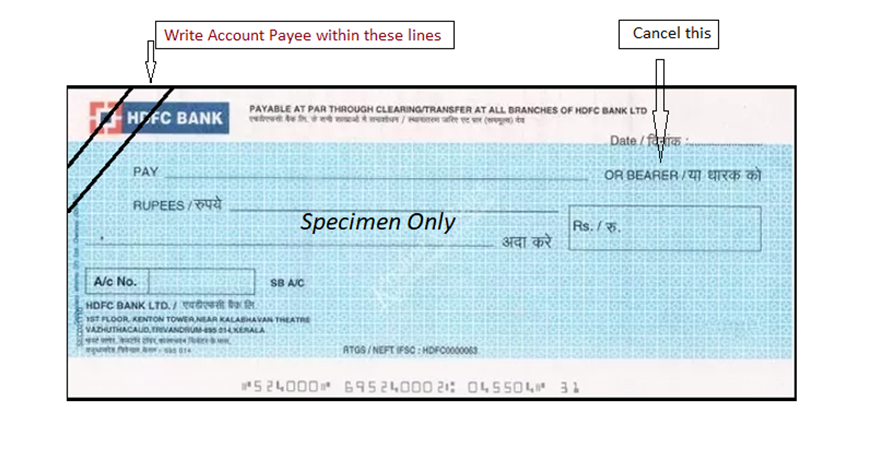

Have a look at the above Account Payee Cheque Sample.

Features of an Account Payee Cheque

The following are the features and benefits of using an account payee cheque:

- Issued in the name of the payee

- No-one else can draw an account payee cheque

- Highly secure than a bearer’s cheque

- Cannot be encashed

- Amount can only be transferred from the issuer’s account to the payee account

How to Write an Account Payee Cheque?

You need to mention the following details on an account payee cheque:

At the front of the Account Payee Cheque:

- Payee Name

- Amount to be paid (words & figures)

- Date

- Cross the cheque by drawing 2 parallel lines at the top left corner & writing Account Payee in between the lines

AND

Cancel the Bearer option

- Sign

Please make sure to put your signature at the Account Payee Cheque back side as well.

How to Deposit an Account Payee Cheque?

To deposit an account payee cheque, follow these steps:

- Go to your bank carrying the cheque

- Ask for a cheque deposit form (it looks similar to a demand draft)

- Fill this cheque deposit form with the following details

- Date of depositing the cheque

- Date of cheque issuance

- Full Name of the bearer

- Branch in which cheque is being deposited

- Bearer’s Account Number and Type of Account

- Name of the branch from where cheque is issued

- Cheque Number & Date

- Rupees and Paisa, if any (in figures and words)

- Telephone Number or Mobile Number of the bearer

- Signature of the Depositor

- Fill the counterfoil and get it signed and stamped by the bank official – this is to be kept with you, the bearer

- Now, attach this fully filled and signed cheque deposit form to your account payee cheque and submit at the bank

Once the cheque is processed, your bank will transfer the said money in your account, as directed in the cheque.

Significance of an Account Payee Cheque

The importance of an account payee cheque stems from the security it offers. This cheque cannot be encashed, i.e. when you write this cheque for someone , they can only get the mentioned amount deposited in their account and not be handed over the said amount in cash, like in a normal cheque. Another important feature of an account payee cheque is that it cannot be deposited by anyone other than the person whose name is mentioned on the cheque.

Also, read more articles related to Cheque:

Account Payee Cheque: FAQs

An account payee cheque is the most secured type of bank cheque as this cheque cannot be encashed. When you write an account payee cheque, you direct your bank to transfer the quoted amount in the beneficiary’s bank account.

An account payee cheque is valid for 3 months from the date mentioned on the cheque.

An account payee cheque can be paid to the payee’s account anytime within 3 months of issuing the cheque.

The issuer must sign at the back side of an account payee cheque along with signing at the front as well.

It usually takes 2 days to clear an account payee cheque.

No. An account payee cheque has to be deposited in your bank only, i.e. the beneficiary’s bank.