Form 16, Form 16A , and Form 16B – confusing enough? Let us simply. Form 16 certifies that your employer has successfully paid TDS on your behalf.

Likewise, Form 16A and Form 16B are TDS certificates for the TDS paid on your income other than your salary and proceeds from sale of immovable property, respectively.

But how do you download Form 16? Let’s understand in detail.

What is Form 16?

Form 16 means a certificate issued to the salaried employees by their employer, as per the 203 of the IT Act, 1961 by your employer.

Simply said, it’s proof of the tax deducted at source (or TDS) on your salary by your employer (if your salary is more than the tax exemption limit). Thus, many times it’s also called as the TDS certificate.

Why Do I Need Form 16?

Treat Form 16 as an evidence of your timely tax payments which implies that you are a regular taxpayer. This form contains detailed information about your income – be it your salary or your income from other sources (that you declare to your employer) – along with the tax deducted at source (TDS) by your employer.

This is a very important document that you will need while filing your ITR or the Income Tax Return. However, please note that this document is provided by your employer only and cannot be downloaded from anywhere else.

There are two parts of Form 16:

Part A: Summary (total amount) of salary paid to the employee and the total tax deducted at source (TDS) by the employer on the employee’s behalf.

Part A of the Form 16 includes the following details:

- Certificate Number

- Name, Address, PAN & TAN of the Employer

- Name, Address & PAN of the Employee

- Employee Reference No. provided by the Employer

- Details of Tax Deducted & Deposited in the Central Govt. A/c through

- (i) book adjustment – Amount of tax deducted and Book Identification Number (BIN) and related details

- (ii) through Challan – Amount of tax deducted and Challan Identification Number (CIN) and related details

Note: This is not an exclusive list. The form also includes important dates, assessment year, etc.

Part B: Detailed information of the salary as well as the tax liability and tax paid – of the employee. Simply said, this is a detailed version of part B, i.e. like an annexure. Here proper break-up of the salary paid as well as any other income and tax deducted is listed in detail.

Part B of Form 16 includes the following details:

- Certificate Number

- Name, Address, PAN & TAN of the Employer

- Name, Address & PAN of the Employee

- Details of Salary Paid & TDS + Other income (if any)

- Gross Salary

- Less: Allowances

- Total salary received from the current employer

- Less: Deductions u/s 16 (4a + 4b + 4c)

- Income chargeable under the head “salaries”

- Add: Any other income reported by the employee u/s 192 (2B)

- Gross total income

- Deductions under Chapter VI-A

- Total taxable income

- Tax on total income

- Rebate u/s 87A

- Surcharge

- Health & Edu. Cess

- Tax payable (j+k+l+m)

- Less: Relief u/s 89

- Net tax payable

- Verification declaration (by the person responsible for the tax deduction)

Note: This is not an exclusive list.

DID YOU KNOW?

If you have changed two jobs in one financial year, tax on your behalf (TDS) might be deducted from both of your employers. Therefore, you must procure FORM 16 from both employers.

What is Form 16A?

Form 16A is a certificate of TDS on income from sources other than salary. This can be TDS on your interest income of fixed deposits (FD), rent receipts, etc.

Form 16A gives details about such incomes and the tax deducted at source (TDS) on the same. Along with these details, like a Form 16, it also has details of the deductee and the deductor (name & address, PAN) along with BIN*, CIN*, etc.

*BIN – Book Identification Number; CIN – Challan Identification Number

What is Form 16B?

Form 16B is the certificate of TDS (Tax Deducted at Source) in case of sale of immovable property, except for rural agricultural land.

This form is provided by the buyer of the property to the seller. As per section 194 – IA of the IT Act, 1961, the buyer has to deduct 1% TDS on the immovable property from the total selling price that they will pay to the seller.

After the sale is made, this TDS is to be submitted to the Income Tax Department. After submission, the buyer is obligated to provide Form 16B to the seller, proving that the due TDS is paid on the transacted property.

How to Download Form 16 Online?

There’s a common misconception among people about downloading Form 16.

Form 16 is an already filled Income Tax form that is provided to you by your employer. You, as an employee, don’t have to fill out this form. This is your employer’s responsibility to provide your Form 16 to you.

Let’s understand this with an example:

Suppose you go to a shop to buy a pair of shoes. Now as you pay the amount, do you ask the shopkeeper to give you the bill/receipt or do you go behind the counter and fill the receipt yourself? – You ask for the bill, right? And why – because this is your proof of payment. In case of an exchange or return, you need the details mentioned in this bill.

Likewise, you will need the details stated in your Form 16 when you file your Income Tax Return. That’s why you must ask your employer to provide you with your Form 16 – and thus – no need to download Form 16 as an employee.

For employers, this form is available on the website of the IT Department. Below are the steps on how to download Form 16 and fill and submit it online:

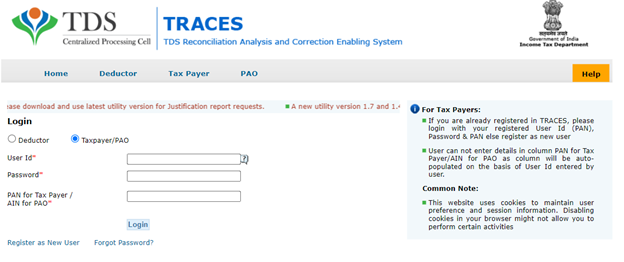

- Go to the TRACES login page, the official online TDS Reconciliation System by the IT Dept. of India.

- Enter your User ID, password ,and TAN and hit the “Login” button.

- Open the “Downloads” tab.

- Select Form 16/16A.

- An online fillable form will open. Fill out this form and hit the “Go” button to successfully submit Form 16 as an employer.

Those who wish to submit this form offline may download this form using the link below:

Details required from Form 16 while filing your return

The following details are stated in your Form 16 provided by your employer that you will need when filing your Income Tax Return:

- Legal Name and Address of the Employer

- PAN of the Employer

- TAN* of the Employer

- Challan Details

- Your total salary break-up (gross salary, deductions, income declared by you from other sources, rebates, surcharge, net salary, taxable income, total tax liability, etc.)

*Tax Deduction and Collection Account Number

Form 16 Eligibility Criteria

Employees (salaried individuals) who fall under the taxable bracket set by the Income Tax Department, i.e. whose income tax is beyond the minimum tax exemption limit, i.e. Rs. 2.5 lakhs, are eligible to receive Form 16 from their employer.

However, if your income is below Rs. 2.5 lakhs, your employer is under no legal obligation to give you Form 16 since no TDS is paid on your behalf.

Difference between Form 16, Form 16A & Form 16B

The following table encapsulates the elements that differentiate Form 16, Form 16A and Form 16B from each other:

| Forms/Particulars | Issued To | Issued By | Income Received From |

| Form 16 | Employee | Employer | Salary |

| Form 16A | Deposit holder (like FD), owner of a rented property | Bank or other financial institutions, tenant of a rented property | Fixed deposit (interest), rent receipts, insurance commission of agent, etc. |

| Form 16B | Seller of this property | Buyer of immovable property of land | Proceeds from selling of such property |

Important:

All these three forms are issued u/s 203 of the Income-tax Act, 1961 for tax deducted at source and form as certificates for TDS thus paid by the deductor on behalf of deductor.

These forms are used to provide income details, TDS amount, PAN & TAN of the deductor, CIN and BIN, while filing ITR by the deductee.

Form 16 is valid income proof and can be asked by your bank when you apply for a loan.

Form 16 has two parts, Part A and Part B (Annexure to Part A) while the other two forms 16A and 16B do not have such segregation.

DID YOU KNOW?

Many banks and other financial institutions accept the latest Form 16 as proof of income when sanctioning loans.

How to File ITR with Form 16?

One can file ITR in two ways, viz. offline and online. In both cases, Form 16 is required.

Steps to File ITR using Form 16 (Online):

- First of all, register your PAN on the e-Filing website of the IT Department.

- If you’re already registered, go to the e-Filing Login Page.

- After logging in, go to the “e-File” option and select “File Income Tax Return”.

- Select the Assessment Year and click on “Online”.

- Select the “Start New Filing” option.

- Choose from “Individual”, “HUF” or “Other” and provide your application status. Click “Continue”.

- Choose the appropriate ITR form. You can also check which form to file by clicking on the help option saying “Proceed”.

- Select the reason for which you are filing your ITR.

- Verify the pre-filled ITR and fill in the details that need to be entered by you manually.

- “Preview Return” to check for the final document that will be submitted.

- After confirming details, “Submit” your return.

FAQs

Form 16 is usable for the following purposes:

· While whiling ITR (details like PAN/Tan of the employer, Challan details, total salary break-up, rebates offered to you, deductions, etc. form as components of Form 16)

· As income proof, while switching jobs or applying for a loan in a financial institution

· Helps in computing your tax liabilities

· When applying for a credit card with a higher limit

· When applying for Visa

Form 16 is needed by employees to show that tax on their salaried income is deducted timely. This is an annual form that the employer is legally bound to provide.

Form 16 can be presented at the time of joining a new organisation and while applying for a loan in a bank to validate your income. Along with this, a salaried employee can understand in detail their taxable income and detailed break-up of their salary received.

All these constitute as benefits of Form 16.

Yes. If Form 16 has not been issued to you for some reason, you may download Form 26A from TRACES, an online TDS reconciliation system by the IT Department. Log in as a taxpayer and download Form 26A from the Downloads sections. Your PAN will become your User ID.

IF your TDS is paid, the details will be stated in this form. If not, you will not find this Form 26A for the assessment for which you want to file ITR.

Ask your employer to provide your Form 16. As an employee, you have the legal right to procure Form 16 from your employer if your income is taxable as per the latest income tax slabs.

For employers, they can go to TRACES, log in using their User ID, password and PAN and then find this form in “Downloads”. There, they can fill, and submit this form online.

As per the IT Act, 1961, every employer has to provide Form 16 to their employees whose salary income is over the minimum taxable limit. So yes, Form 16 is mandatory. However, employees whose salary income is within the minimum taxable limits do not get this form as no TDS is paid on their behalf.